CLOSING BELL

Wall Street Gettin’ Hammered

The market fell on a stormy day on the East Coast. As Hurricane Erin battered the Carolinas and late August beachgoers, the AI tech sell-off battered traders for the fifth red day.

Walmart earnings came in as a beat, but warnings of tariff price increases hurt future prospects. More EU and U.S. tariff frameworks dropped after the heads of state met in the White House this week, talking Ukraine. Though there are more details to come, 15% levies look like they are here to stay, without exemptions for steel, semiconductors, most pharma products, or aluminum.

Fed Speak out of Jackson Hole has mostly been inconclusive, with FOMC head Jerome Powell to speak Friday. The Fed is calling the speech an “Economic Outlook and Framework Review.” 👀

Today's issue covers Cracker Barrel goes ‘woke,’ Fed Speak gets spicy, and more. 📰

2 of 11 sectors closed green, with energy $XLE ( ▼ 0.42% ) leading and staples $XLP ( ▼ 0.81% ) lagging.

STOCKS

Facelift Or Crack-Down? Either Way, Trad Brands Hope Changes Bring Customers 🛢

Shares of old-fashioned styled restaurant chain Cracker Barrel fell 7%, sending the stock to a top trending spot on Stocktwits after the company unveiled a new, simpler logo as a part of a brand refresh.

Fans of the brand expressed concern that the original old man character was an eraser of traditional Americana, a sentiment that conservative voices helped amplify. Crackerbarrel was founded at the end of the 60s in Tennessee, and has undergone a facelift that started in 2024 to its brand, as Chief Julie Felss Masino bragged during the firm’s last earnings call. The brand has refurbished 20 restaurants, with a focus on brighter, more welcoming designs. For a layperson, the new logo looks like every other ‘flattened’ corporate logo redone in the past decade. 🤷

The crackdown brings memories of the backlash against the perceived backlash to an American Apparel ad featuring Sydney Sweeney in jeans earlier this year, and even the Anheuser-Busch advertising controversy in 2023 over a transgender influencer sent free beers, according to CNBC.

In market (not culture wars) terms, traditional sit-down brands are facing a reconning in the post-COVID era, according to Bloomberg. Even the perception of inflation and a slowing economy this year has sent chain stocks sinking 20% following poor Q2 reports compared to 2024.

Some brands, like Chili’s Brinker International, Cheescake Factory, and Cracker Barrel, are bucking the trend, as their stocks climb this year. Succeeding sit-down brands are offering value meals and major deals to bring in penny-pinching consumers, according to John Peyton, CEO of Dine Brands Global Inc., and Eric Gonzalez, an analyst at Keybanc Capital Markets Inc.

Chipotle Mexican Grill has dropped 28% in 2025 despite launching drone delivery tests with Zipline, as retail investors remain skeptical of its valuation and premium multiple. 🌮

SPONSORED

Why Thousands of People are Tapping Into This New Way to Invest

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900%.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same early investors that backed Uber, Venmo, and eBay also backed Pacaso. And you can join them. But not for long. This opportunity officially ends on 9/18.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Comparisons to other companies are for informational purposes only and should not imply similar success.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Fed Drama And Fed Speak Grips Macro Heads 📺

It’s finally Jackson Hole Fed Speak time, a beautiful time of year, this season punctuated by a record-high market struggling with inflation and high interest rates. Powell is due to make a speech tomorrow, but his fellow FOMC members have given lip service to the idea that September’s monetary policy meeting will be a stressful decision. The last FOMC projection showed that on average, members think two cuts are in order before 2026.

Of the 12-person FOMC committee, two Trump-appointed members want a cut now, Wednesday’s meeting minutes from July showed. Christopher Waller and Michelle Bowman voted that the committee should cut. Speaking Thursday, Atlanta Fed President Raphael Bostic said he thinks the opposite and sees only one rate cut this year. 🥩

Kansas City Federal Reserve President Jeffrey Schmid, in a CNBC interview Thursday expressed doubt about lowering interest rates in September, saying there’s more work to do on inflation.

“We’re in a really good spot, and I think we really have to have very definitive data to be moving that policy rate right now,” he said

Fed’s Hammack said Thursday she would oppose interest rate cuts if the central bank met tomorrow.

“We have inflation that’s too high and has been trending upwards over the past year. With the information I have, if the meeting was tomorrow, I would not see a case for reducing interest rates,” she said.

Right after the bell, the Fed President of Chicago, Austan Goolsbee, told Bloomberg that Fed independence is critically important, but that the next Fed meeting would be live. 🎥

He also said the most recent data on labor and producer inflation was not great. The most vital questions are how much prices will rise from tariffs, and when sellers will price in trade costs, he said.

Outside of Fed Speak, the Fed is undergoing some seat changes that could alter the voting dynamics soon, spurred on by the rate cut-hungry Trump Admin. Recent drama pits Federal Reserve Governor Lisa Cook against the DOJ, and Trump wants her to step down. The DOJ plans to investigate Cook for mortgage fraud alleged by Federal Housing Finance Agency Director Bill Pulte, and sent a letter to the Fed recommending she leave.

“I have no intention of being bullied to step down from my position because of some questions raised in a tweet,” Cook said in a statement.

If she is forced out or steps down before her Biden-appointed 2038 end date, it would give Trump another seat to appoint, following the departure of Adriana Kugler at the start of the month. Trump’s two appointees from his first term are both calling for a cut.

From Stocktwits’ Litepaper writer Jonathan Morgan, Jackson Hole: What Happens After? 🤔

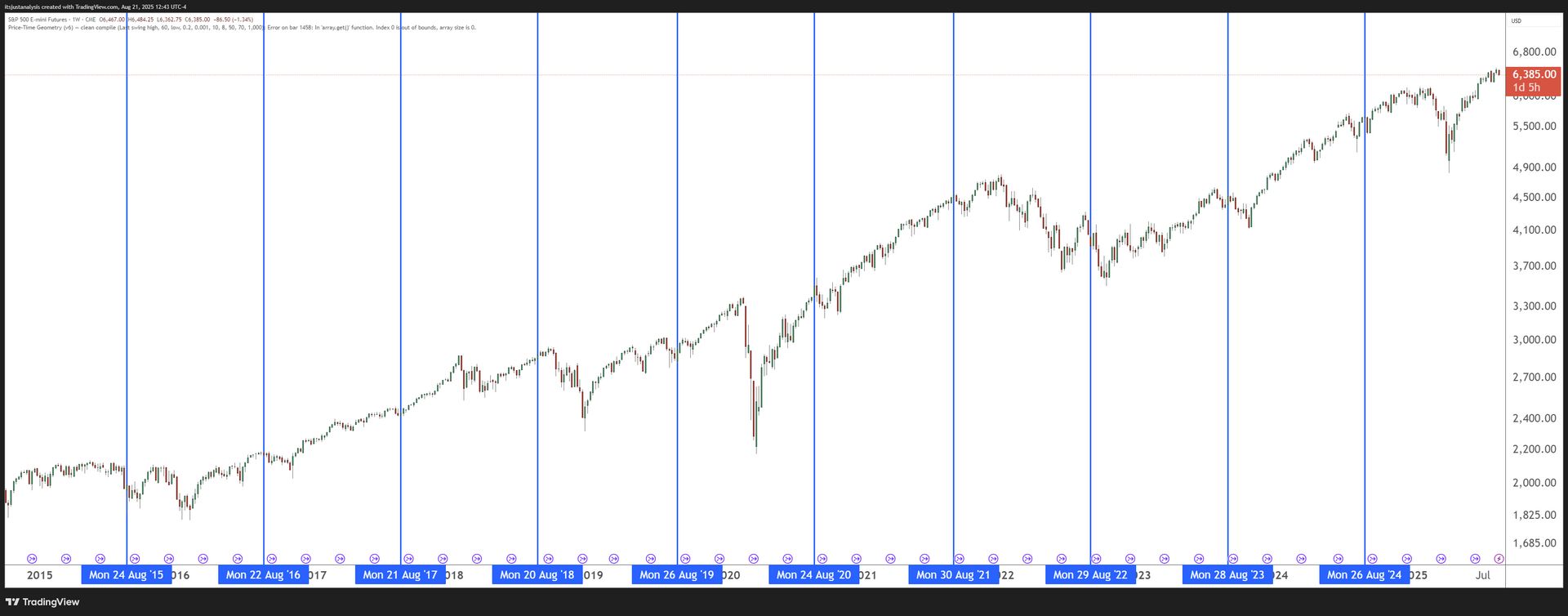

Let’s line up ES (S&P futures) and Bitcoin and see how they moved after the last 10 Jackson Holes. 🧠

Read more, and learn how Futers and Bitcoin reacted in the past —> The Litepaper by Stocktwits 📆

IN PARTNERSHIP WITH THE CMT ASSOCIATION

Join Stocktwits Editor-in-Chief Tom Bruni At The CMT Association’s Global Investment Summit 🧑🏫

Hi everyone, Tom Bruni here! I’m thrilled to be heading to Dubai this September for the CMT Association’s 2025 Global Investment Summit. I’ll be joining 30+ top speakers and hundreds of market pros for three days of insights, networking, and big-picture market discussions. My session will focus on how traders and investors are using Stocktwits sentiment data to navigate today’s markets. 🧭

It’s all happening at Dubai’s iconic Museum of the Future from September 30 to October 2. The CMT Association is offering a special discounted rate exclusively for the Stocktwits community. Register below—I’d love to see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Walmart flagged rising costs from new tariffs, with CEO Doug McMillon noting increased pressure on middle- and lower-income households and retail sentiment turning “extremely bullish.”

Nvidia is seeing robust chip demand, according to UBS and Wedbush, with Q2 revenue expected near $46B and bullish sentiment rising ahead of its August 27 earnings report.

Anthropic is reportedly seeking $10 billion in fresh funding, with its valuation potentially reaching $170 billion amid rising competition with OpenAI and xAI.

Boeing is reportedly finalizing a 500-plane deal with China, potentially marking its largest-ever commercial order and signaling a thaw in U.S.–China aerospace relations.

DraftKings may enter the prediction market space, with Jefferies maintaining a ‘Buy’ rating and noting potential acquisition of Railbird as a strategic route.

Instacart was downgraded to ‘Underperform’ by Wedbush due to Amazon’s aggressive same-day grocery expansion. Retail sentiment went bearish, and shares slipped over 2%.

Nio unveiled its third-generation ES8 SUV starting at RMB 416,800, featuring advanced autonomous tech and battery subscription options, with retail sentiment surging to “extremely bullish.”

Bitcoin held near $113,600 ahead of Powell’s Jackson Hole speech, while altcoins like Ethereum, Solana, and Cardano posted gains, and retail sentiment remained bearish.

MetaMask launched its native stablecoin mUSD, issued by Stripe-owned Bridge and backed 1:1 by liquid dollar-equivalent assets via M0’s decentralized infrastructure.

U.S. Manufacturing PMI surged to 53.3 in August, marking its fastest expansion since May 2022 amid strong demand and rising pricing pressures.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Opendoor’s $82 Blueprint, Eric Jackson’s Asset-Light Play, and Miners Pivoting to AI

Daily Rip Live with Katie Perry and Shay Boloor welcomes Dr. Eric Jackson, founder, president, and portfolio manager at EMJ Capital, known for his bullish call on $OPEN ( ▼ 2.54% ) that helped turn the iBuying firm into a meme stock.

Watch for a no-BS breakdown of his Opendoor thesis, the playbook for an asset-light pivot, and why retail’s “Open Army” might force the board’s hand. We also hit miners morphing into AI infrastructure, assumable mortgages as a policy unlock, and yes, the Drake meme that’s taken over FinTwit.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Chair Powell Speaks (10:00 AM), Jackson Hole Symposium (8:00 PM) 📊

Pre-Market Earnings: BJ’s Wholesale Club ($BJ), Gold Fields ($GFI) 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋