Presented by

CLOSING BELL

We're Back (For A Little)

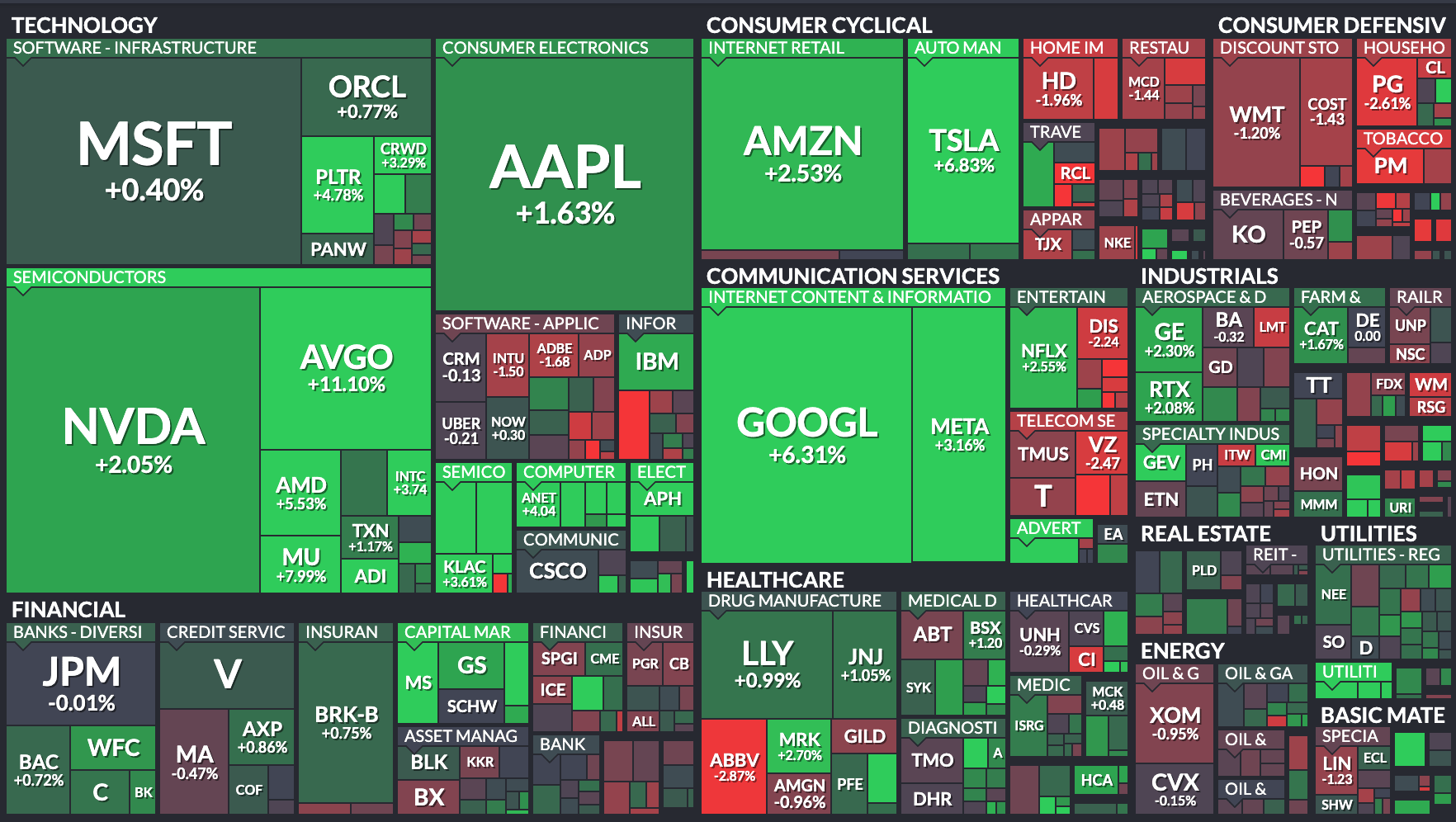

The market climbed to start a short holiday week Monday, big tech leading the way higher. It was the best day for the S&P 500 in six weeks, and the QQQ climbed the most since May. It’s a short week, but it started green.

Morgan Stanley Analyst Michael Wilson said in a note that he sees volatility slowing down, and to buy the dip: “Any further weakness in the short-term as an opportunity to add long exposure into next year.”

Blomberg reported Wilson and MS are bullish on consumer discretionary, healthcare, financials, industrial, and small-cap stocks. Wilson also said a possible FOMC rate cut in two weeks could send prices higher. Speaking of, Fed Reserve Gov. Waller and San Fran Fed Pres Mary Daly said they were voting for a cut to help the labor market, joining John Williams in the same call last week. CME futures jumped to an 84% chance of a cut.

It’s also Thanksgiving week, so aside from braving the planes, trains, and automobiles to get home for turkey day, Americans will also be Christmas shopping. Consumers are expected to spend $622 between Black Friday and Cyber Monday, a Deloitte survey found.

In the White House, the president held a phone call with long-distance pen pal Xi, and the admin said it was aiming for a 2-year Obamacare extension, sending stocks like Oscar Health ripping. 👀

9 of 11 sectors closed green. Tech $XLK ( ▲ 1.3% ) lead and staples $XLP ( ▲ 0.87% ) lagged.

AFTER THE BELL

Zoom Climbs, Beats Earnings 📹

Zoom $ZM ( ▲ 1.69% ) rose Monday in the post-market, posting adjusted earnings in the third quarter of $1.52/share. The video conferencing software company beat Street estimates of $1.44, a 10.1% jump from last year. Revenue climbed 4.4% to $1.23 billion, narrowly beating the consensus of $1.21 billion.

What’s Driving the Beat? The quarter highlights show this is a story of profitability and platform expansion, not a sudden surge in growth.

The Enterprise Engine is Strong: Enterprise revenue grew 6.1% to $741.4M, maintaining its lead as the key revenue driver. Crucially, the number of customers contributing over $100,000 in TTM revenue grew 9.2% (to 4,363), suggesting success in cross-selling.

The Power of AI: CEO Eric Yuan highlighted that adoption of AI Companion is growing 4x YoY and that nine of their top ten customer experience (CX) deals involved paid AI features (like Virtual Agent), signaling a clear path to AI monetization.

Cash Flow and Buybacks: The company's disciplined approach led to a massive 30% YoY jump in Operating Cash Flow to $629.3M. This financial strength allowed the board to authorize an additional $1.0 billion for its share repurchase program, further signaling management’s confidence and commitment to boosting shareholder returns

Zoom has morphed from a pandemic-era growth darling into a high-margin, cash-generating machine that is expertly managing its costs while expanding its product suite (Zoom Phone, Zoom Contact Center) and leaning heavily into AI.

The real headline? ZM's full-year outlook is looking significantly better than previously thought. Zoom significantly raised its Fiscal Year 2026 forecast, projecting adjusted EPS of $5.95–$5.97 (a big win over the Street's $5.88 estimate) and revenue of $4.852–$4.857 billion (beating the analyst consensus of $4.834 billion).

This improved guidance signals management's confidence in higher profitability and an additional $20 million+ in top-line sales, showing their cost management and enterprise growth strategies are paying off better than expected.

According to Koyfin, the average analyst’s estimate for Zoom stock is $93.04, implying about 18% upside from current levels.

$SNDK ( ▼ 4.2% ) was climbing Monday, and flew 7% higher after the bell, when Barron’s reported the Small Cap leader would join the S&P 500 Nov. 28.

SPONSORED

Unlock New Investment Opportunities with GalaxyOne

Qualifying as an accredited investor may not be as out of reach as it sounds. Nearly one in five U.S. households already qualify through annual income or total net worth1. Accredited investor status opens doors to investment opportunities often reserved for institutions, from private equity to premium yield products.

At GalaxyOne, our goal is to make growing your wealth simple. With our streamlined verification process, your accredited investor status can be verified quickly, typically within one business day.

Through December 7, verified accredited investors on GalaxyOne can earn a $500 bonus on a deposit of $25,000 or more2 into their GalaxyOne Cash Account.

1U.S. Securities and Exchange Commission. (2025, August 12). Qualifying households by Financial Criteria (1989 - 2022).

2Limit one per person. Maintain new balance 60 days.Terms at galaxy.app/bonus.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

CRYPTO NEWS

When Bitcoin And Meme Stocks Go Together: Market Both 🥇

Activist investor and Opendoor bull Eric Jackson is rolling out a new product called $EMJX, the meme stock investor said over the weekend, calling it a Gen 2 multi-asset AI treasury. It was a Sunday twitter post that really marks an era, with the most hype retail trader buzzwords this season all in one place.

Jackson said he wasn’t buying crypto treasury companies like $MSTR ( ▲ 0.73% ), and instead is launching his own, but did not specify what that meant, or even what asset the treasury stock will target.

Jackson indicated that $EMJX is not an ETF or ETP, focusing on this unique derivative product instead of buying into existing crypto-treasury firms. Jackson also called out Shopify, $SHOP ( ▼ 0.3% ) saying the digital storefront provider needed to start using AI big time or risk a loss of market share.

Speaking of MSTR, chief Michael Saylor struck a defiant tone over the weekend after JPMorgan analysts warned that $MSTR risked exclusion from major indices like the MSCI USA Index.

MSCI warned it was considering cutting treasury companies from its major index lists, and other companies might follow suit. Saylor pushed back, clarifying that $MSTR is a "publicly traded operating company with a unique treasury strategy that uses Bitcoin as productive capital," not merely a fund or trust. His comments fueled calls for a JPMorgan boycott by loyal Bitcoin advocates. Good luck boycotting the largest bank in the U.S.

Want the full story? Tap the links below:

IN PARTNERSHIP WITH

The Turtle System That Turned Rookies into Millionaires

A simple system turned rookies into millionaires. In the original Turtle experiment, a rules-based trend-following strategy helped a group of new traders compound gains dramatically over time. That same rules-based system is now free in the TrendSpider Store as the complete Turtle Traders collection.

Scan for live breakouts. Automate entries and exits. Backtest decades of data on any ticker.

Try TrendSpider for $50c a day then save up to 65% during Black Friday. Get a free bonus offer when you sign up.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

President Trump said he had a "very good call" with Xi Jinping on trade.

Grindr stock sank after its board halted buyout talks over financing concerns.

Spot gold is on track to snap a two-day loss due to Federal Reserve rate cut hopes.

Ondas stock climbed 29% as defense deals and investments fueled investor optimism.

Dogecoin ETF launched on NYSE, though an analyst predicts the hype will be short-lived.

Capricor Therapeutics stock fell 19% after Martin Shkreli announced a short position.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: ADP Employment Change Weekly (8:15 AM), PPI (8:30 AM), Pending Home Sales MoM (10:00 AM), Atlanta Fed GDPNow Q4 (12:00 PM), 5-Year Note Auction (1:00 PM). 📊

Pre-Market Earnings: Castor Maritime Inc ($CTRM), Anavex Life Sciences Corporation ($AVXL), Kohl`s Corp. ($KSS), and Best Buy Co. Inc. ($BBY). 🛏️

After-Market Earnings: Cleanspark Inc ($CLSK), Dell Technologies Inc ($DELL), and Zscaler Inc ($ZS). 🌕

Alibaba Group Holding $BABA ( ▲ 0.22% ) : EPS estimate $0.66, revenue estimate $34.43B

Best Buy Co. Inc. $BBY ( ▲ 0.03% ) : EPS estimate $1.31, revenue estimate $9.58B

Analog Devices $ADI ( ▲ 0.27% ) : EPS estimate $2.22, revenue estimate $3.01B

NIO Inc. $NIO ( ▲ 0.19% ) : EPS estimate -$0.24 (loss), revenue estimate $3.26B

Dell Technologies $DELL ( ▲ 0.54% ) : EPS estimate $2.48, revenue estimate $27.27B

HP Inc. $HPQ ( ▼ 0.82% ) : EPS estimate $0.91, revenue estimate $2.42B

Workday, Inc. $WDAY ( ▲ 0.79% ) : EPS estimate $2.12, revenue estimate $2.41B

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍