CLOSING BELL

Dodge Tariffs With This One Small Trick ($100B)

The market climbed Wednesday, after yet another hefty batch of earnings results and trade updates. Apple helped pull the tech market higher, climbing 5% despite news that the Trump admin would raise taxes on imports from India to stem the flow of Russian oil. Turns out, Chief Tim Cook made a deal: Apple will miss the 25% additional tariffs after the White House said the smartphone giant was pledging a further $100B to U.S. manufacturing.

Part of the plan is to build iPhone glass in Kentucky, hiring 20k employees, and build data centers, bringing the total pledged domestic investment to $600B, according to after-hours reports and the press event at the White House. The president also said he wanted a 100% tariff on chips and semiconductors. 👀

Bloomberg Live TV

Today's issue covers earnings are getting rough, Stocktwits heads to the Stock Exchange, and more. 📰

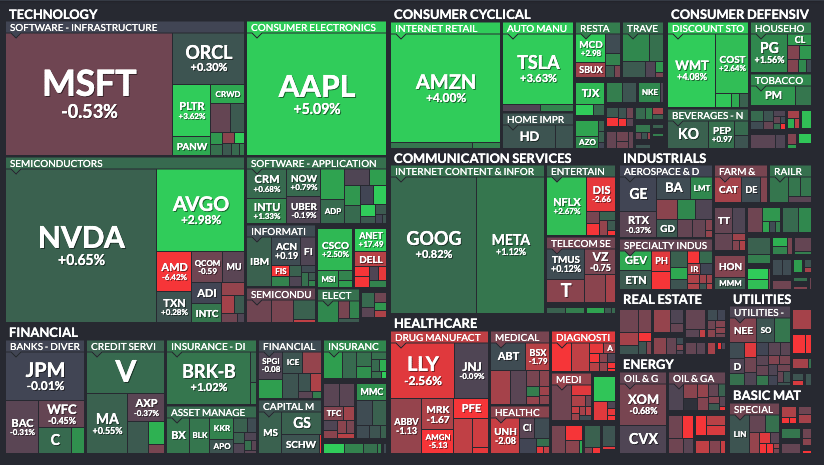

With the final numbers for indexes and the ETFs that track them, 6 of 11 sectors closed green, with discretionary $XLY ( ▲ 1.52% ) leading and health care $XLV ( ▼ 0.42% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,345

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,315

Russell 2000 $IWM ( ▲ 1.09% ) 2,221

Dow Jones $DIA ( ▲ 0.78% ) 44,193

HUMP DAY EARNINGS RESULTS

The Market Is Pricing Beats Low But Misses High 🙃

The hottest earnings week yet has brought forth a new idea: investors are getting more cautious when firms miss analyst expectations. Here are the major reactions and reports today, starting with after-hours earnings you may have missed:

Airbnb posted Q2 results after the market closed that beat estimates, but the room share company painted a more cautious Q3 and second half of the year, right around the $4.02 that analysts expected. The stock fell 6% after hours.

Lyft reports results and struggles to keep up with competitor Uber, which reported earlier in the day. The stock fell about 5% in early night trade.

DoorDash was climbing after its report included a triple header: A Q3 outlook that beat estimates, revenue of $3.28B that grew 25%, and an EPS that was 4% above what Wall Street expected.

DraftKings reported a Q2 sales jump and record revenue, and the stock climbed about 2%

Doulingo took the crown for after-the-report climbs Wednesday night, up nearly 15% after the language learning app reported nearly double the quarterly profit than a year ago.

Before The Bell

McDonald’s climbed about 3% after stronger-than-expected results in Q2, with a 5% revenue growth to $6.84B.

Arista Networks was the S&P 500’s top gainer, up 17% after the cloud networking company reported a 30% revenue jump above estimates to $2.21B. Morgan Stanley, Piper Sandler, UBS, and Goldman Sachs analysts raised their price forecasts on the stock.

Shopify beat Q2 earnings with a 31% YoY revenue jump, sending the stock flying 21%.

Though the week started with the majority of stocks listed on the S&P 500 already touting earnings report beats, YahooFinance reporter Josh Schafer pointed out a grim reality: misses mean big drops when the market is at all-time highs.

SPONSORED

Meet the ChatGPT of Marketing—And You Can Still Buy In at $0.63

RAD Intel has been called the ChatGPT of marketing—and for good reason.

Their AI helps brands like Hasbro, MGM, and Skechers identify the right audience and predict what content drives real action. Think Google or Meta-style targeting—rebuilt for the AI era.

Adobe, Fidelity, and insiders from Google, Meta, and Amazon are already in. RAD has JUST reserved its Nasdaq ticker ($RADI), grown 1,600% in valuation, and delivered up to 3.5X ROI for major brands.

And it's still private—with shares available at just $0.63. More than 9,000 investors are already on the cap table.

Missed Nvidia? Missed Shopify? This is your second shot.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKTWITS TALKS SHOP

Katie Perry Talks Crypto With Michael Novogratz, CEO of Galaxy Digital 🌟

Galaxy Digital CEO Mike Novogratz said the firm must be “radically different” by 2030 to win in on-chain credit and global data infrastructure amid rising crypto demand and regulatory shifts. Read more, or check out the full interview below!

🔮 What’s Next for Galaxy?

🧠 More services like on-chain credit and tokenized wallets

🏢 Aim to be the biggest data center company in America

🚀 Launching new projects next quarter

📅 Thinking ahead to 2030 and beyond

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Uber CEO Dara Khosrowshahi teased new robotaxi partnerships after a strong Q2 report, sparking a 190% surge in retail message volume and bullish sentiment. Read more

PepsiCo is facing a class action lawsuit alleging it gave Walmart unfair price advantages through exclusive promotions and allowances, violating antitrust laws. Read more

Bitcoin dropped below $114K as XRP, Solana, and Dogecoin led a broader crypto selloff amid $1.3B in ETF outflows over four days. Read more

Disney fell nearly 3% after a revenue miss, but said it will fully integrate Hulu into Disney+ and launch a standalone ESPN streaming service on August 21. Read more

Swiss President Karin Keller-Sutter met with Marco Rubio to discuss the U.S.'s proposed 39% tariffs on Swiss imports, which could impact 1% of Switzerland’s GDP. Read more

AMD CEO Lisa Su said she’s seeing “a lot of positive signals” in computing demand and noted “good indications” on China export licenses after Q2 earnings. Read more

Super Micro missed Q4 expectations, but analysts remain split as retail sentiment turns extremely bullish and AI infrastructure hopes persist. Read more

Trump advisers are urging an interim Fed appointment to replace Adriana Kugler, giving him flexibility ahead of Jerome Powell’s May 2026 succession. Read more

Zeta Global surged in retail sentiment after Q2 earnings beat expectations, prompting Canaccord and BofA to raise price targets on confidence in its data strategy. Read more

Amazon’s Zoox received a federal exemption allowing its steering-wheel-free robotaxis to operate on U.S. roads, as NHTSA closed its safety probe and retail sentiment around Amazon surged. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS ECOSYSTEM

Coming Soon To A Trading Floor Near You…

We’re teaming up with FINTECH.TV to bring real-time retail sentiment to the heart of institutional finance, combining our 10M+ investor community and proprietary data with their global media platform and New York Stock Exchange studio!

🎥 First up: “Treasuries Unchained” — a new flagship series diving into corporate crypto treasury strategies and the growing intersection of TradFi and DeFi. 🤑

Launching soon, live from the NYSE, the series will feature:

• Executive interviews with market-shaping leaders (starting with Meanwhile CEO Zac Townsend)

• Insightful coverage designed for both institutional pros and retail investors

The first in-depth interview will debut in mid-August, featuring Surf Air Mobility Inc. (NYSE: SRFM) Co-Founder Sudhin Shahani.

Keep an eye out!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Continuing Jobless Claims (8:30 AM), Initial Jobless Claims (8:30 AM), FOMC Member Bostic Speaks (10:00 AM), NY Fed Consumer Inflation Expectations (11:00 AM), 30-Year Bond Auction (1:00 PM). 📊

Pre-Market Earnings: Cronos Group ($CRON) and Peloton Interactive ($PTON). 🛏️

After-Hour Earnings: Block ($XYZ), Microvision ($MVIS), Gilead Sciences ($GILD), Cleanspark ($CLSK), Blink Charging ($BLNK), SoundHound AI ($SOUN), Twilio ($TWLO), and Pinterest ($PINS). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. disclo here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋