Presented by

CLOSING BELL

Welcome Back To The Red

The market tanked Friday, the first +-1% change for the S&P 500 for weeks, and ended with a nearly 3% haircut. Equities were green in the morning, but one long tweet from Trump sent markets down, as the president threatened brand new massive tariffs on China and shelved plans for a meeting with Chinese President Xi later this month. The Fed also began massive layoffs, by one source, firing 200k federal workers as a part of the ongoing Government shutdown.

John Belton Gabelli, Funds Portfolio Manager, said the market was waiting for a down day after enjoying a 40% climb since liberation day. Belton said it was just one day, and we will know more after Trump speaks more this weekend, and when markets open on Columbus Day. That clarification came quickly: Trump later Friday announced plans to impose an additional 100% tariff on Chinese goods, effective November 1, which would bring the total tariffs to 130%.

Tech got hit the hardest; it’s the worst day since April 10th. The market is open on Monday, a high-volume day that many people have off, so there's plenty of time to trade; let’s hope it rebounds. 👀

Today’s RIP: Trump tweets sending market falling back a month, Bitcoin miners are now AI datacenters, Peace prize insider trading, and more. 📰

1 of 11 sectors closed green, with staples $XLP ( ▲ 0.87% ) leading and tech $XLK ( ▲ 1.3% ) lagging.

MACRO STOCKS

Days Since Tariff Talk Crashed The Market: 0

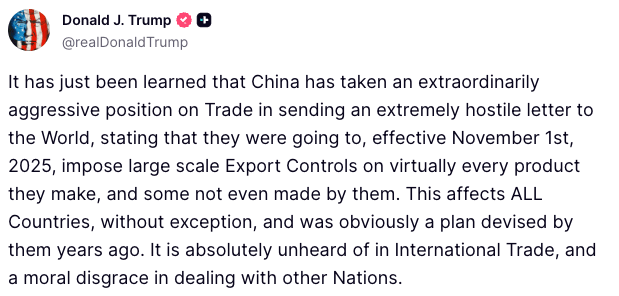

The market fell the most since the major tariff announcement after a rare earth spat. China announced new export controls days ago, but it’s as if Trump noticed today, taking to Truth Social to tweet out a 500-word rant. Trump sees ‘no reason’ to meet with Xi, after China’s ‘hostile’ export moves.

Late Friday, Trump tweeted specifics.

Trump’s call for 100%+ tariffs, if implemented, brings the total to a little lower than the 145% threat needed at the beginning of his administration, but still higher than ever before.

The major indexes fell, Bitcoin $BTC.X ( ▼ 0.71% ) was down, Eth $ETH.X ( ▼ 0.18% ) pulled back 7%, and the $SMH ( ▲ 1.52% ) Vaneck Semiconductor ETF fell overall, as Nvidia and chip makers pulled back 4%-5%. After the second tweet hit Friday before 5 PM, the S&P 500 fell further, hitting the 50-day moving average.

youch

China controls 70% of rare earths, and this week started to require licenses for U.S. firms to export products containing rare earths or using Chinese refinery equipment starting Dec. 1.

Tom Keene, managing editor of Bloomberg News, said there is a difference between risk and uncertainty. Risk is quantifiable and can be priced in, but uncertainty is frightening to markets.

Katie Greifeld, Bloomberg Reporter, said this could be a hopeful revival of the ‘Trump Always Chickens Out’ Taco Trade, and that this is just part of a negotiation strategy. 🌮

SPONSORED

POET Powers AI Connectivity

POET Technologies has entered a phase of rapid commercialization and announced a $75 million financing this week. With industry validation from customers such as Mitsubishi Electric, Foxconn, Luxshare and NTT, POET is poised to address the immense demands of the AI industry.

In 2025, POET opened a state-of-the-art manufacturing facility that prepares it for the expected growth in sales orders from current and future customers. POET's Optical Interposer-based products are lower cost, consume less power than comparable products, are smaller in size and readily scalable to high production volumes.

In addition to providing high-speed (800G, 1.6T and above) optical engines and optical modules for AI clusters and hyperscale data centers, POET has designed and produced novel light source products for chip-to-chip communication within and between AI servers, the next frontier for solving bandwidth and latency problems in AI systems.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Bitcoin Miners? You Mean AI Datacenters 💾

Applied Digital $APLD ( ▲ 2.2% ) climbed after the one-time bitcoin miner, now datacenter-for-hire company, reported Q1 2026 numbers that beat expectations.

The company’s Thursday night showed a 84% jump in data center revenue to $64M. The firm builds data centers to rent out its processing power to the highest bidder, which, for the past couple years, was $MARA ( ▲ 2.22% ) bitcoin mining.

The company said its North Dakota Polaris FORGE data center, leased to Coreweave $CRWV ( ▲ 9.31% ) is up and running and leased for the next 15 years.

It’s not the only bitcoin miner outfitting for the next fad: mining industry stocks were one of the only green industries on Friday after Bernstein analysts said bitcoin miners were well-equipped to jump the cryptoship and start renting processing power to AI companies.

IREN $IREN ( ▲ 7.3% ) and TeraWulf $WULF ( ▲ 11.99% ) , CleanSpark $CLSK ( ▲ 5.4% ) were all climbing.

DEGENERATE ECONOMY

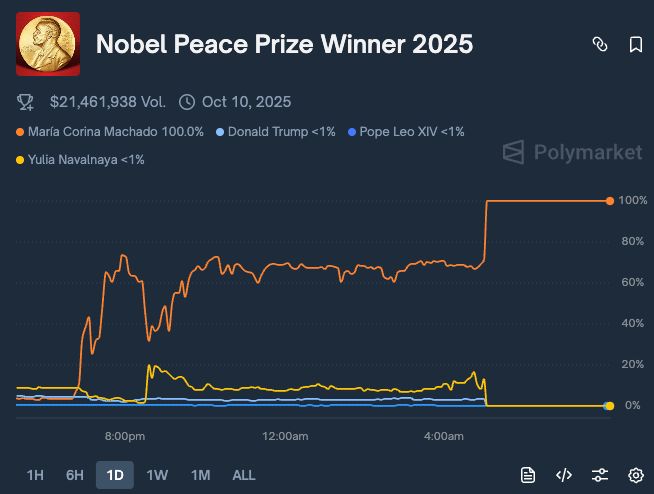

Polymarket Bet On Nobel Winner Looks Like Insider Trading 🤔

Some things are too good to be true. Norwegian authorities are looking into an insider trading scandal after this morning’s Nobel Peace Prize went out to Venezuelan opposition leader Maria Corina Machado, but her odds of winning the prize spiked hours before the official release on the bet-on-anything app Polymarket.

According to Bloomberg, the chances Machado would be the selected winner jumped right after the five-member Norwegian committee decided around midnight local time.

“We take this very seriously,” Kristian Berg Harpviken, director of the Norwegian Nobel Institute, told Bloomberg. “It seems we have been prey to a criminal actor who wants to earn money on our information.”

Some traders made their first bets ever on the decision, making tens of thousands on their bets. Lucky, or dastardly?

Harpviken said it’s happened before that the word got out before the public decision, but never in a way that involved betting. 🃏

POPS & DROPS

Top Stocktwits News Stories 🗞

Labor Department to resume CPI work despite government shutdown.

AstraZeneca reportedly nears drug pricing deal with Trump.

Crypto markets plunged after Trump’s China tariff threat.

Levi Strauss fell 12% after margin concerns post-earnings.

Kalshi doubled valuation to $5B after new private funding.

AST SpaceMobile fell 5% despite Verizon deal and equity raise.

IonQ fell 8% after $2B equity offering.

Fed’s Waller backed more rate cuts but urged caution.

Serve Robotics fell 15% after $100M direct offering.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Breaking News Every Morning: Let It RIP

The Trump Tweet made me reshoot because the market tanked right after I was finished saying markets were great on Friday.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍