CLOSING BELL

What's Holding Us Back?

The market closed higher with another fractional gain for the S&P 500. What is holding it back? Well, the U.S. dollar index is hitting its lowest level since 2022, despite wholesale PPI inflation numbers increasing less than expected. The market is still unsure how to price in tariff changes this summer. President Trump teased he might ratchet up auto tariffs, again, less than a week after he doubled aluminum and steel tariffs to 50%.

Trump has less than a month before liberation day 2.0, and it’s anyone's guess as to how it will play out.

In serious news, Boeing fell after a 787 Dreamliner bound for London crashed in a suburb of western India, with an unknown number of survivors of the 242 people on board.

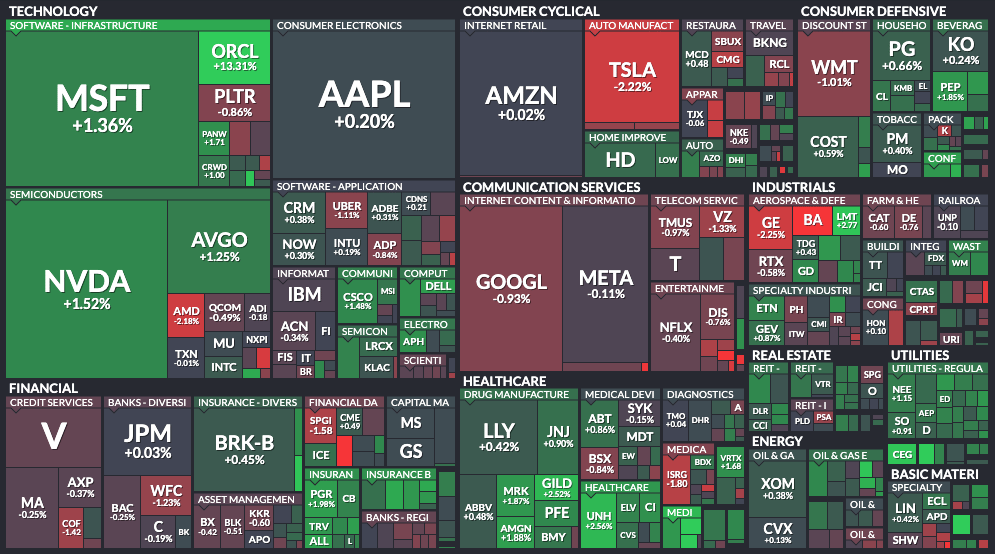

With the final numbers for indexes and the ETFs that track them, 7 of 11 sectors closed green, with utilities $XLU ( ▲ 0.38% ) leading and communications $XLC ( ▲ 0.21% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,045

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,1913

Russell 2000 $IWM ( ▲ 0.56% ) 2,140

Dow Jones $DIA ( ▲ 0.58% ) 42,967

STOCKS

RH And Adobe Both Beat Estimates, But Furniture Flew While Software Floundered After The Bell 🔔

Restoration Hardware flew after the firm’s after-market earnings beat estimates.

The stock was up as high as 19%, after the imported furniture firm unexpectedly swung to a profit, and revenue rose to $814M in the first quarter. The firm even reiterated its fiscal year growth guidance, in the 10-13% range.

Adobe, meanwhile, did not fare as well posting its results. The photo editing ‘AI software’ firm reported second quarter earnings beating estimates, and raised its full year and next quarter outlook above the average Bloomberg estimate.

Still, the stock did not enjoy the stock climb post-market that $RH ( ▼ 3.07% ) did, in part because of the increasingly tight expectations for the hyper-competitive software and AI-related space.

PRESENTED BY

Why This AI Stock Was Rated a “Strong Buy” on Yahoo Finance

Wall Street gives this AI stock a 270% 1-year growth target. But investors today have an opportunity of 500%.

HeartSciences (Nasdaq: HSCS) is using AI to make heart disease detection easier. And their breakthrough AI-ECG tech is on the verge of a major value catalyst: FDA submission this summer.

This is the kind of event Wall Street typically watches closely—FDA clearance could unlock significant commercial potential and help drive new market value.

That’s why analysts have a 1-year target share price as high as $14. While public shares have recently traded as high as $4.49, investors can now get in for just $3.50 per unit.

Each unit includes:

1 share of preferred stock (convertible into Nasdaq-traded common stock at any time)

This gives investors a 1-year potential upside of 500% based on the same Wall Street analyst projections.

We believe now is the time to act and invest.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

This is a paid advertisement for HeartSciences Regulation A+ offering. Please read the offering circular at https://invest.heartsciences.com/

IPO NEWS

Chime Rings In A Smash Hit IPO On First Trading Day 💍

Neobank Chime surged more than 60% in its Nasdaq debut, pushing its valuation to $18.4 billion as investors bet on the digital bank's rapid growth and fintech momentum. The stock finished up about 37%, notching a closing price of $37/share.

The price opened at $27, already higher than the expected range.

Chime was a staple fintech name for years, catering toward the ‘unbanked’ lower-income population of Americans who make under $100,000 a year or less. The firm prides itself by generating revenue through interchange within credit card networks from its debit and credit cards, as opposed to interest and overdraft fees that it claims run other banks’ payrolls.

The climb comes on the public offering heels of $CRCL ( ▲ 33.93% ) and $ETOR ( ▲ 6.9% ) in the past weeks, as Wall Street buys up IPOs like it’s 2021 again, the covid years that saw a record high 1,035, the highest number of IPOs, according to Stock Analysis.

eToro climbed 23% after its May 14th IPO, and Circle is trading at more than double its June 5th opening price.

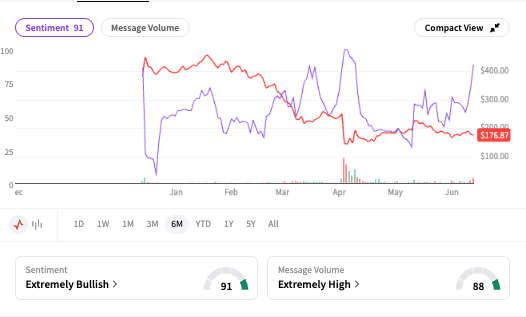

Stocktwtis users were maxing out sentiment and message volume, but poll respondents said they were mostly avoiding the opening trading day altogether.

PRESENTED BY STOCKTWITS

🚨 Why It’s Trending Just Got Even Better! 📈

Why It’s Trending provides concise, AI-generated, real-time summaries that explain why a stock or crypto is trending on Stocktwits. It highlights key market-moving events and retail sentiment to empower confident investment and trading decisions.

Real-Time Insights: Get up-to-the-minute summaries powered by Stocktwits’ proprietary data, stream messages, and retail sentiment.

Simple & Clear: No jargon, no fluff—just concise explanations that save you time.

Community-Powered: Instantly jump into relevant discussions and make informed posts.

For Every Trader: Whether you’re new or experienced, you’ll instantly grasp why a stock or crypto is making moves.

How to Access It?

Use the newly added Trending Widget on the Stocktwits Homepage (under the Market Overview section on web)

Hover over any stock or crypto in the Trending Bar (web only)

On any stock or crypto page, hover over the Trending Badge or Tap the Blue Fire Icon (on apps) next to the symbol name

P.S. You’ll receive instant notifications when any stock or crypto in your Stocktwits watchlist is trending. Make sure you turn on notifications and keep your watchlist up to date.

POPS & DROPS

Top Stocktwits News Stories 🗞

Oracle surged after Wall Street analysts raised price targets following strong Q4 results, with bullish forecasts for cloud growth and AI-driven revenue expansion. 40% owner Larry Ellison surpassed Jeff Bezos and Mark Zuckerberg to become the world's second-richest person. Read more

Senate advanced a Trump-backed stablecoin bill, setting up a final vote on legislation that would regulate dollar-pegged cryptocurrencies amid bipartisan debate. Read more

Victoria's Secret lowered its full-year profit forecast by $50 million, citing tariff pressures, but retail sentiment remains optimistic following a solid Q1 report. Read more

Trump warned that an Israeli strike on Iran "could very well happen," citing concerns over Tehran's nuclear ambitions and ongoing diplomatic negotiations. Read more

Goldman Sachs lowered its U.S. recession probability to 30%, citing easing uncertainty around Trump's tariff policies and improving financial conditions. Read more

Tesla fell after Trump signed legislation terminating California's EV mandate, reversing rules that required 100% zero-emission vehicle sales by 2035. Read more

Cardinal Health raised its FY25 earnings guidance, now expecting adjusted EPS of $8.15 to $8.20, up from its prior forecast, as retail sentiment turned bullish. Read more

Warner Bros. Discovery's decision to split into two independent companies signals a broader shakeout in the media industry, as streaming dominance reshapes traditional business models. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

MAKE YOUR VOTE

Is the Market On Its Way Back To All-Time Highs?

Check in with this Stocktwits poll, as the market approaches records again. When will the S&P 500 break 6,147?

NEWS

Air India Flight Crash

An Air India flight crashed just after taking off at about 4 am ET Thursday morning. India confirmed nearly all bodies from the Air India crash have been recovered, with authorities launching a mass DNA identification effort to finalize the official death toll. Read more

$BA ( ▼ 1.48% ) shares fell after the first tragic fatal crash of a 787 Dreamliner. Boeing helped pull down the Dow, with investigations into the crash from Indian authorities, Air India, the airplane maker, and support from the U.S. underway.

At least one passenger made it, Ramesh Viswashkumar, in seat 11A, who told the Hindustan Times he had heard a loud noise thirty seconds after takeoff, right before the crash. Viswashkumar said he was traveling with his brother, who has not yet been found.

Never take a day for granted, and I wish you all safe travels. ❤ 🇮🇳

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Michigan Consumer Expectations, Sentiment (Jun) (10:00 AM), U.S. Baker Hughes Oil Rig Count (1:00 PM), U.S. Baker Hughes Total Rig Count (1:00 PM). 📊

Pre-Market Earnings: MoneyHero ($MNY). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋