CLOSING BELL

When Memes Come To The White House

from tenor

The market fell slightly on Thursday, as the GOP tax bill passed and heads to the Senate for final deliberation. Trump has given his party until July 4th for the bill. Based on treasury yields, the bond market is not happy with yet another spending bill that increases the deficit and cuts taxes.

The top $TRUMP.X ( ▲ 4.72% ) holders are headed to an investor dinner with the president tonight in Virginia, with Tron founder Justin Sun as the self-proclaimed lead holder with $18M in his Trump meme token wallet. 👀

Today's issue covers Solar Should Have Saved Up For A Rainy Day, IPOs Are Back, Baby, and more. 📰

With the final numbers for indexes and the ETFs that track them, 2 of 11 sectors closed green, with consumer discretionary $XLY ( ▲ 0.22% ) leading and utilities $XLU ( ▲ 0.38% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 5,842

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,112

Russell 2000 $IWM ( ▲ 0.56% ) 2,046

Dow Jones $DIA ( ▲ 0.58% ) 41,859

IPOS

IPOs Are Back, Baby 🚒

Hinge Health $HNGE ( ▲ 2.47% ) and $MNTN ( ▲ 0.31% ) flew after both firms went public on Thursday.

Hinge Health priced its IPO at $32 per share, raising $437 million, and opened at $39.25. The firm is a San Fran-based tech platform for treating musculoskeletal conditions, like chronic pain.

MNTN, a TV adtech firm, priced at $16 per share and surged 45% on debut. Analysts view these successful listings as a positive sign for the broader IPO market, which has been recovering after a prolonged slowdown.

It’s great news for IPO backers- firms like Insight, Atomic, and Tiger Global must have celebrated when their IPO baby Hinge came into the world today.

Last week, eToro raised $620M, the first major listing since CoreWeave and liberation day.

Stocktwits users are bullish on both HNGE (above) and MNTN

SPONSORED

He’s Already IPO’d Once – This Time’s Different

Spencer Rascoff co-founded Zillow, scaling it into a $16 billion real estate giant.

But because everyday investors couldn’t invest until after the initial public offer (IPO), they missed out on early momentum and the cheapest share prices. “I wish we had done a round accessible to retail investors prior to Zillow’s IPO,” Spencer later said.

Now he’s doing just that. Spencer has teamed up with Austin Allison, another Zillow executive, to launch Pacaso, a co-ownership marketplace disrupting the $1.3 trillion vacation home market. And unlike Zillow, you can invest in Pacaso as a private company. (Top firms like SoftBank and Maveron already have.)

But today’s $2.80 share price will only last until May 29. After increasing gross profit by 41% last year, topping $110 million total, Pacaso has reserved the Nasdaq ticker PCSO in preparation of a potential public offering.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

…EXCEPT DEATH AND TAXES

Solar Should Have Saved Up For A Rainy Day 🌦

Solar stocks plunged after the House passed a GOP tax bill that accelerates the phaseout of clean energy incentives. Sunrun fell nearly 40%, Enphase Energy dropped 20%, and SolarEdge slid 24% as the legislation eliminates tax credits for leased rooftop solar systems.

Guggenheim analysts said the bill was ‘disastrous’ for the industry. Most solar companies use Biden-era and older tax credits for lease arrangements, which the GOP bill passed in the House aims to cut. The bill also ends credits for energy facilities, which CNBC attributed to the rapid expansion of solar projects across the U.S.

Utility-scale solar developers also saw declines, with Array Technologies down 13% and Nextracker off 6%. Analysts warn the bill could trigger a $220B investment loss by 2030. Greentech has only one hope: the Senate. 🧓

Trump’s tax bill narrowly passed the House 215-214 after intense negotiations, with two Republicans joining all Democrats in opposition. The legislation, dubbed the “big, beautiful bill,” extends Trump’s 2017 tax cuts, eliminates taxes on tips and overtime, and includes major Medicaid and SNAP cuts.

Federal Reserve Governor Christopher Waller said the bill was worrisome- the Congressional Budget Office estimates the tax plan will cut taxes for the rich, and worsen resources for the poor, despite overtime and SALT benefits. The CBO estimates the bill will add nearly $4T to the deficit over the next decade. 🤑

In positive news, Waller said that the Fed could cut interest rates in 2025 if Trump keeps tariffs around 10%.

Stocktwits retail is still bullish on solar. Cast Your Vote!

SPONSORED

OpenAI Shattered Search. RAD Intel Owns What’s Next – and up 1600%

OpenAI’s Chat GPT changed how people search, shop, and decide. RAD Intel is helping Fortune 1000 brands profit from it.

Meet RAD Intel, a new player quietly owning the content conversation space, delivering up to 3.5x ROI for major brands like Hasbro, MGM, and Skechers. RAD’s AI-driven platform predicts what content – and creators – will drive results before a single dollar is spent.

With 1600% growth, an $85M valuation, and backing from Adobe and Fidelity Ventures, RAD Intel is upending trillion-dollar categories like fashion, retail and lifestyle with AI that’s built to scale– and already delivering real results.*

Now, their Regulation A+ offering is open and everyday investors can own a piece of the AI disrupting marketing right now. RAD Intel just locked in its NASDAQ ticker: RADI — and shares are open to the everyday investors at $0.60, but not for long.

⏳ Deadline: May 29. After that, the price changes.

**Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A offering and involves risk, including the possible loss of principal. The valuation is set by the Company. Please read the offering circular and related risks at invest.radintel.ai. 3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Noteworthy Stories From Stocktwits News 🗞

Advance Auto Parts $AAP ( ▼ 6.1% ) flew after the firm reported Q1 revenue of $2.6B, beating estimates of $2.51B, despite a 7% YoY decline. The company posted an adjusted loss per share of $0.22, but its forward guidance stole the show. Instead of warning that its highly tariff-impacted goods would suffer this year, the firm expects FY2025 revenue between $8.4B and $8.6B, with adjusted EPS ranging from $1.50 to $2.50.

Hims & Hers shares fell 8% after Cigna’s Evernorth division announced a $200/month cap on out-of-pocket costs for Wegovy and Zepbound, undercutting Hims & Hers’ pricing.

Snowflake $SNOW ( ▲ 5.56% ) shares jumped after reporting better-than-expected Q1 earnings. Revenue grew 26% YoY to $1.04B, beating estimates of $1.01B, while adjusted EPS of $0.24 exceeded forecasts of $0.21. Analysts raised price targets, with Morgan Stanley lifting its target to $200, Wells Fargo increasing to $225 , and Piper Sandler boosting it to $215. The price closed over $200 for the first time in more than a year.

BYD surpassed Tesla in European EV sales for the first time in April, registering 7,231 battery-electric vehicles compared to Tesla’s 7,165. This marks a significant shift, as Tesla’s sales dropped 49% YoY while BYD’s surged 359%. Analysts call it a “watershed moment” for the European EV market.

$ROST ( ▲ 0.61% ) Fell 10% right after reporting its results following the closing bell. Revenue and EPS beat estimates, but the firm pulled its guidance. Ross said more than half of its goods come from China, and if tariffs keep up, its sales will suffer.

FIFA partnered with $AVAX.X ( ▲ 15.7% ) to launch its own Ethereum Virtual Machine (EVM)-compatible blockchain, moving its FIFA Collect NFT platform from Algorand to the new network. The crypto climbed while Bitcoin hit a record just below $112k.

LiveRamp shares surged 19% after reporting better-than-expected Q4 earnings. Revenue climbed 10% YoY to $189M, beating estimates of $185.41M, while adjusted EPS of $0.30 exceeded forecasts of $0.28. Analysts raised price targets.

PRESENTED BY STOCKTWITS

Make Your Call Heard!

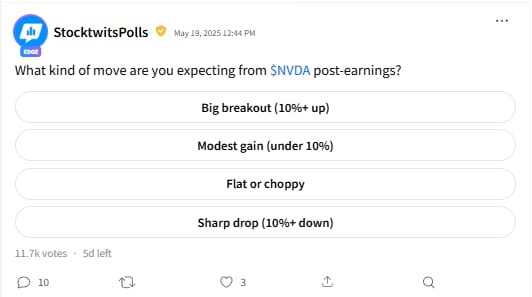

Nvidia is finally set to report next week, on the 28th. What do you think, will they beat and raise, pull their guidance, or miss?

Stocktwits Polls (@StocktwitsPolls) Make sure to vote!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: New Home Sales (10:00am) Fed Cook Speech (12:00pm) 📊

Pre-Market Earnings: Booz Allen Hamilton ($BAH), Buckle ($BKE), MINISO Group Holding ($MNSO). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋