Presented by

CLOSING BELL

Worst Day In A Month

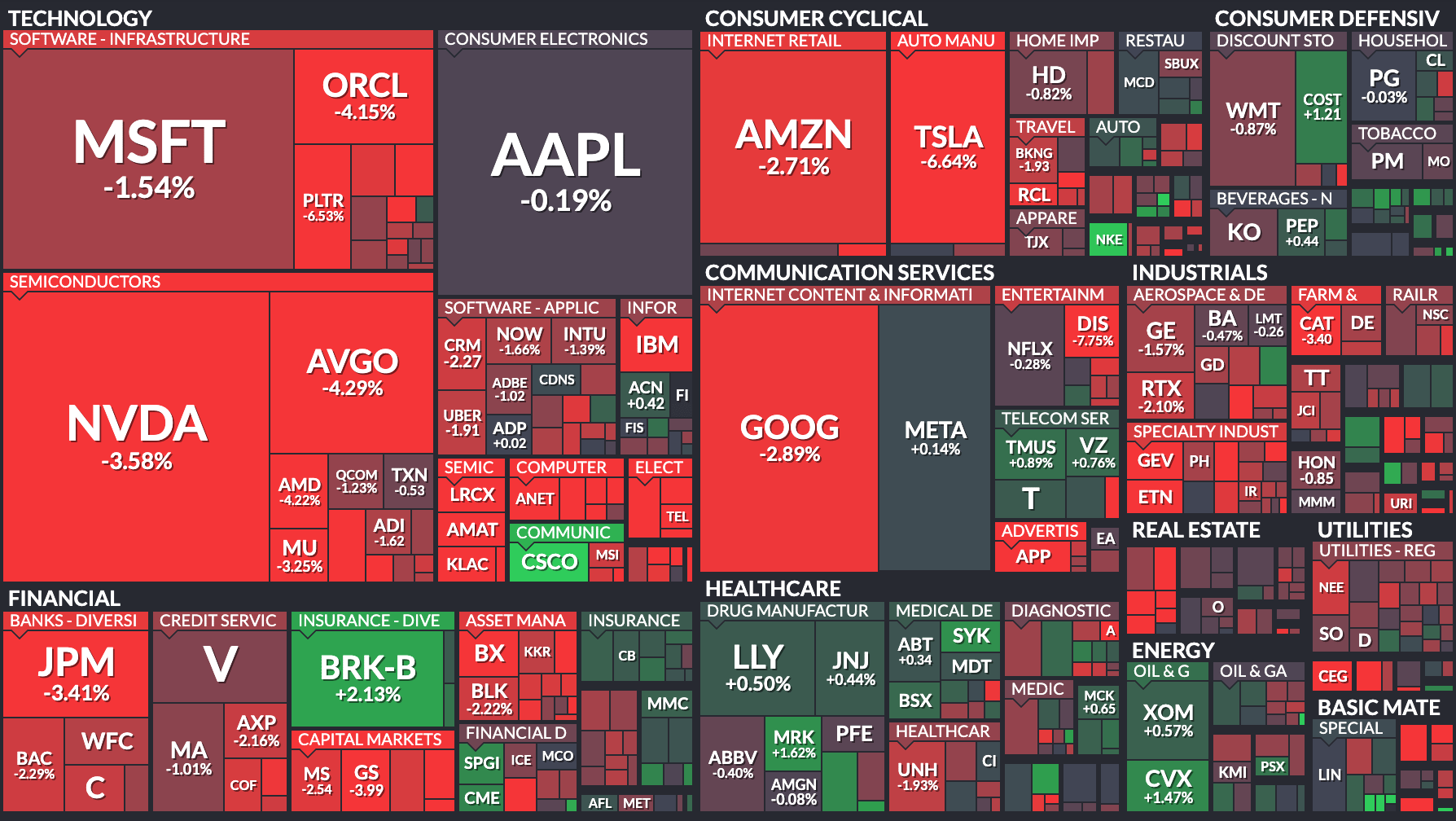

The market fell on Thursday. Traders sold to celebrate the reopening of the Federal Government after a record shutdown. Prices entered a red bleed-off that erased any gains the market had made in November.

Now that the Fed is returning to its desks, it looks like a rate cut and economic outlook for the slim remainder of the year is no longer a done deal. Data on October jobs will come out, advisor Kevin Hassett said, but don’t expect clarity on unemployment, the main driver of calls for rate cuts at the final FOMC meeting in December. The sure thing cut now looks more like a 50/50 coin flip, depending on what futures or betting market you check Thursday night.

Bitcoin dropped below $100k again right after the bell, sending crypto stocks like Strategy to a one-year low. 👀

Today’s RIP: Stubhub misses Swifties, market sells off on shutdown end, Hood does house calls, and more. 📰

1 of 11 sectors closed green. Energy $XLE ( ▼ 0.09% ) lead and discretionary $XLY ( ▲ 1.52% ) lagged.

AFTER THE BELL

StubHub Misses The Swift Effect 👑

StubHub was falling after the bell. $STUB ( ▲ 2.69% ) The ticket seller tanked 18% in its first earnings report as a Public company, losing nearly $1.30 per share more than the street expected it to. It was a $1.33B net loss, compared to a dramatically smaller $46M loss attributable to stockholders in the same period last year.

Last year, the company was enjoying the results of Taylor Swift’s massive Eras Tour. But a lack of sales was not the main issue- the ticket machine pulled in $2.4B in the quarter, not even $300M more than the $2.2 it pulled in the Swiftie year. The largest line item for operational costs was $1.4 billion paid out in stock compensation. IPOs aren’t cheap, and neither is convincing private shareholders to go public.

Applied Matterials $AMAT ( ▲ 1.17% ) was lower, following a pot market report on a red day for chip stocks and chip manufacturing supply stocks. Revenue fell 3%, but still came in above expectations at $6.8B, and Chief Dickerson said they expected their AI side of the firm to grow 40% every year. Still, red chip stocks at noon, nighttime reporters beware… or however the nautical saying goes. ⚓

SPONSORED

When Washington Buys, Markets Boom: Military Metals Corp. $MILIF on Investors’ Radar

When Washington takes a stake, markets notice - and move fast.

Since the U.S. government invested in MP Materials, its stock climbed more than 200%. Lithium Americas nearly doubled and Trilogy Metals surged over 400% - clear proof that when Washington steps in, markets move.

Historically, the government’s support begins with billion-dollar names before filtering down to smaller companies positioned to move the needle.

As Bloomberg reports, attention is now turning to Military Metals Corp. $MILIF, advancing high-grade antimony projects in Nova Scotia, Slovakia and Nevada - antimony is a metal essential to defense systems, semiconductors and clean-tech manufacturing, yet largely controlled by China and Russia.

As Washington’s strategic investment trend continues, Military Metals Corp. $MILIF could be next in line for a similar breakout.

This content is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any securities. Investing involves risk, and past performance is not indicative of future results. Readers are encouraged to conduct their own due diligence and consult a licensed financial advisor before making any investment decisions. The views expressed herein are not financial advice and are those of the author at the time of publication.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRENDING NEWS

Hood Falls After Giving Out Cash, Retail Darlings Fall On Red Day 😡

Robinhood fell 9%, it was one of the biggest losers on the S&P 500, right after launching a cash ‘gopuff.’ Investors did not seem to value the ability to withdraw funds, and have cash brought directly to a user’s door, like they were too hungover to go to an ATM.

The service is for Robinhood Gold members who have at least $1,000 of cash in their account, and costs $7. The stock is up 3X this year, and the market sold this newly announced ability to cause a bank run from the comfort of the couch by ordering cash like a Chipotle burrito. The feature will hit the streets of New York, San Fran, Philadelphia, D.C. the company said in a release.

It might not have been a cash to door that caused the sell off, $IBKR ( ▲ 0.53% ) competitor Interactive Brokers also sold off, following even bigger names in the brokerage and investment banking sector. JPMorgan, Goldman Sachs, and Bank of America were hitting -3%.

Another segment near and dear to retailers’ hearts that was falling was data centers.

Cipher, Iren, and Nebius were down, $NBIS ( ▲ 1.96% ) trending as it fell on Stocktwits.

With the fall of Bitcoin, stocks like $MSTR ( ▲ 0.73% ) and $MARA ( ▲ 2.22% ) were hit hard.

Weed stocks were falling, $TLRY ( ▲ 4.9% ) and $CGC ( ▲ 1.74% ) hurt by provisions of the new government funding bill that said they could not sell delta-8 THC adjacent intoxicants at gas stations and convenience stores in 2026. Tilray leadership said the ban might push buyers toward the black market. Oh, the horror. 😆

QUARTERLIES

Morning Reports Show A Mis-matched Market

$DIS ( ▲ 1.57% ) Disney fell Thursday, leading the Dow lower. It missed revenue expectations, its video entertainment segment falling 6% to $10.2B, while it’s parks and cruises rose 6% to $8.77B.

The mouse said Streaming was finally paying off as a segment, climbing 39% in its Q4, and $1.3B in operating income. It wasn’t enough to clean up the video side of the business, and revenue came in at $22.46B, below estimates.

The mouse is still in negotiations to get ESPN on YouTubeTV, and boasts 196M Disney+ subs, combined with Hulu. Still, with that deal cleared up in the coming quarter, the mouse said it grew EPS 19% for the full year, and expects double-digit growth to earnings in 2026, as well as a doubled share buyback plan.

$ONDS ( ▲ 2.06% ) Ondas was up a huge 30% early on in the day, despite a 3C loss a share, the drone company rose its forward guidance to $36M for '25, boasting 8X the rev in the past quarter than a year ago.

If You Can’t Make It On The Strip, Go Gamble Somewhere Else

$FLUT ( ▲ 2.57% ) Flutter dropped, posting a Fanduel Revenue miss, a net loss of $789M and a 5% decline in U.S. sportsbook revenue. Launching FanDuel Predicts this year, but said that what amounts to its users winning too many bets, and competition is fierce in the betting world when prediction markets are flying off the shelves.

Both it and DraftKings are pulling out of Nevada sports betting in favor of nationwide prediction market goals. It’s a symbolic Las Vegas holdover; the state is one of five in the U.S. that are demanding betting apps not expand into predictions. Nevada is threatening a ban from sports betting on the strip. 🃏

“It has been made clear to the board that Flutter Entertainment/FanDuel and DraftKings intend to engage in unlawful activities related to sports event contracts,” Nevada regulators told Bloomberg. “This conduct is incompatible with their ability to participate in Nevada’s gaming industry.”

POPS & DROPS

Top Stocktwits News Stories 🗞

Alibaba and JD faced weak Singles’ Day sales in China.

Grayscale filed for IPO, planning NYSE listing under ticker GRAY.

Ripple’s XRP rose as anticipation built for the first Nasdaq spot XRP ETF.

IEA forecasted 2026 global oil surplus of 4.09M barrels per day.

Tesla fell 7% after reports of testing Apple CarPlay integration.

Bloom Energy fell 19% after its inclusion in new leveraged ETF.

Bitdeer fell 19% after announcing $400M convertible notes offering.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Daily Market Updates Before You Go On Launch Break, Everything You Need To Know, IYKYK

@stocktwits After 43 days, the government is back open 🇺🇸 #letitrip #disney #governmentshutdown

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: FOMC Member Bostic Speaks (9:20 AM), Atlanta Fed GDPNow (12:00 PM), U.S. Baker Hughes Total Rig Count (1:00 PM), FOMC Member Bostic Speaks (3:20 PM) 📊

Pre-Market Earnings: Iterum Therapeutics ($ITRM), LM Funding America ($LMFA), Zhibao Technology ($ZBAO), and Interactive Strength ($TRNR) 🛏️

Links That Don’t Suck 🌐

📈 Spot high-performance stocks with David Ryan's Ant Indicator––try 4 weeks of MarketSurge for $24.95*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍