Presented by

CLOSING BELL

Worst Jobs In 20+ Years

The market climbed on Tuesday, the major indexes hitting all-time closing highs, despite morning cuts to the past year of labor market data. A normal data revision showed that for 12 months that ended in March 2025, the economy added less than half the 1.79M jobs previously recorded. All told, it’s 911k fewer job additions than previously thought, pushing equities higher on the hopes labor weakness will bring jumbo rate cuts next week. Jamie Dimon warned that the economy is weakening after the numbers. The updates took the form of annual tax filing data, cutting apart the less accurate monthly survey-based updates.

After the bell, the Supreme Court motioned to hear the emergency tariff case on a fast track schedule, giving the Trump admin a chance to defend its justification for record-high levies in November. 👀

Today’s Rip: Apple’s new phone sure is slim, GME and Oracle climb after the bell, Fox owner finalizes Succession, and more. 📰

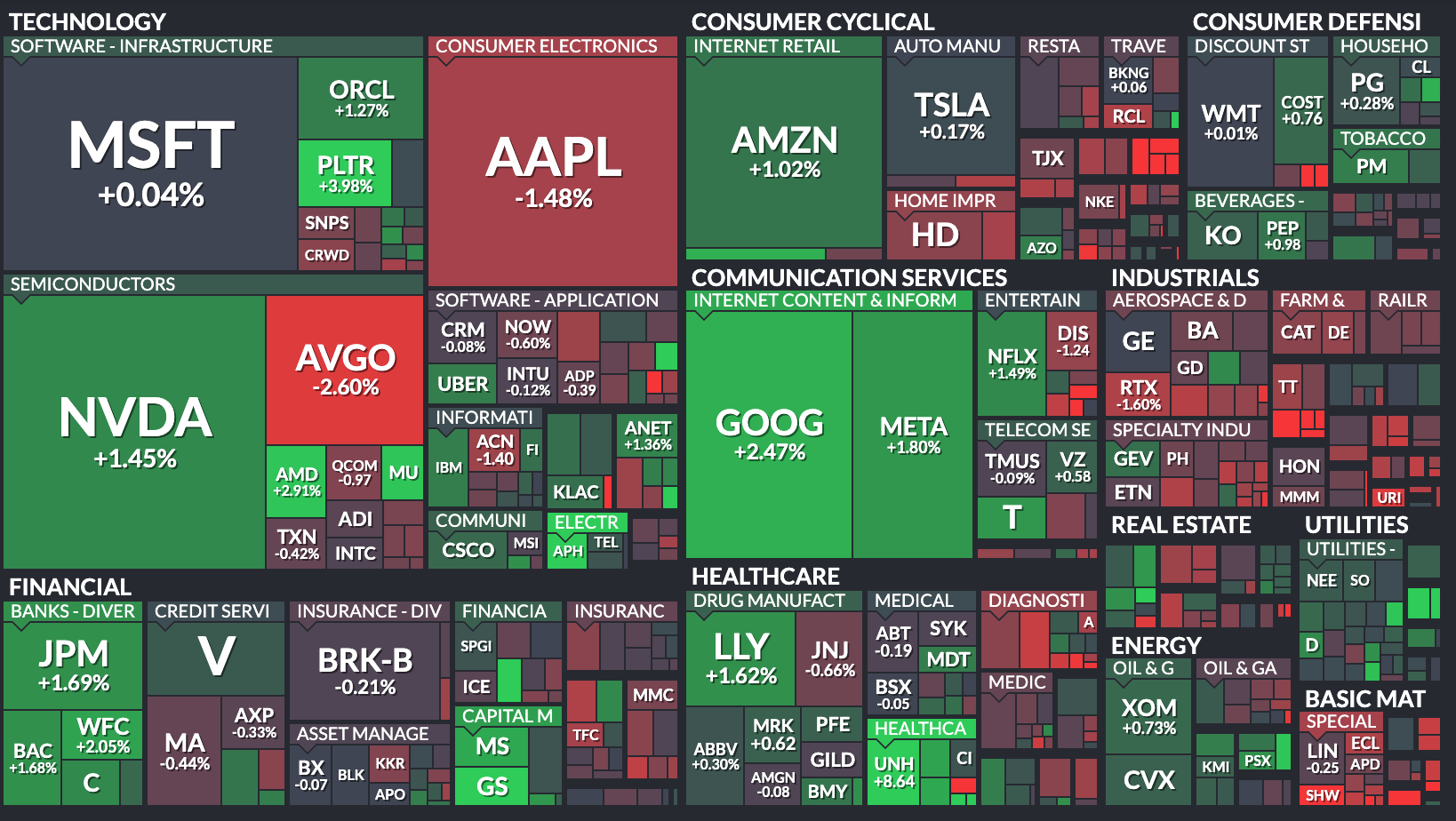

7 of 11 sectors closed green, with utilities $XLU ( ▲ 0.34% ) leading and materials $XLB ( ▼ 0.56% ) lagging.

TECH

Apple Launches New $1k Phone, You Buying?

The live news event of the day was Apple’s product event, where it announced new flagship iPhones, AirPods, and watches. It’s iPhone Air stole the show, marking a major redesign, but its stock sold the news $AAPL ( ▲ 0.77% ) as the sole falling Mag 7 name on Tuesday.

It’s the thinnest phone yet, with titanium and ceramic construction and a new A19 chip, but the question on everyone's mind is, will it sell?

Futurum Group CEO Daniel Newman told CNBC that it’s not a new question. Investors have been waiting for good news since the launch of Apple AI last year, which has not pulled in results from a massive user base. Apple did not raise prices for its models this year, but is that enough?

“The problem with Apple is that everything that’s showing up today is, in fact, pretty incremental. Yes, the phone is thinner, and yes, it looks great. We haven’t had a big supercycle in four years,” Newman said.

Next week, Apple is launching its iOS 26, with an all-new design look called “liquid glass.” Maybe they are hoping it will inspire users to buy new phones? 💧

SPONSORED

The Newsletter Wall Street Hopes You Never Find

Wall Street has built an empire on investor ignorance. They sell “diversification” while feeding you old, recycled strategies.

With the H.E.A.T. Formula we show you what they won’t say out loud:

That most portfolios are sitting ducks — and your advisor probably doesn’t know it.

You’re not just reading a newsletter. You’re joining the side that sees the game for what it is — and knows how to play it.

The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

👉 Click here to get the one newsletter Wall Street prays you never find.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

After The Bell Movers

GameStop climbed $GME ( ▲ 1.89% ) climbed after the meme stock posted rising sales, and profit of $168.6M, compared to $14.8M in the same period last year. That’s a huge increase. It’s in part due to the launch of the Switch 2. The company also said it was granting a warrant for every 10 shares held of stock, which will allow holders to buy a share for $32 in October. The stock traded at $23/share, so here’s to hoping it will be an attractive offer in a month.

Oracle $ORCL ( ▲ 1.2% ) shares jumped a whopping 22% in the after-market period, posting a 359% jump in booked sales, and said its current order book amounts to half a trillion dollars. The good news for the cloud infrastructure company sent shares of semiconductor stocks higher. Chief Safra Catz said their book is growing fast, with four multi-billion dollar contracts in Q1.

"As a bit of a preview, we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year,” Catz said. “Then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years.”

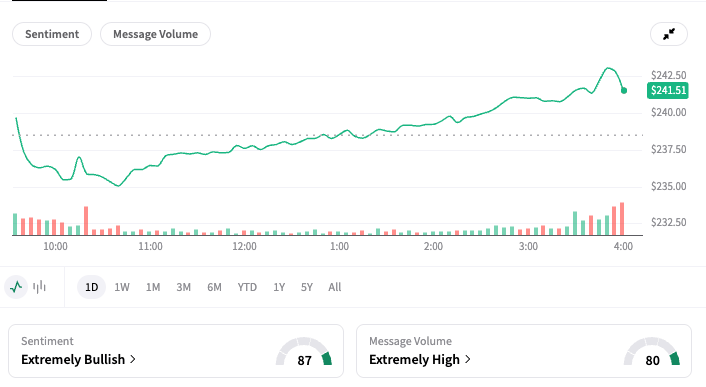

Oracle sentiment climbed to Extremely Bullish in the lead-up to the report.

It wasn’t all golden after the bell, though. Synopsys $SNPS ( ▲ 1.92% ) shares fell nearly 20% after the software and semiconductor tech design company posted Q3 results that missed estimates. Wall Street wanted $1.76B in revenue, but got $1.73B. SNPS also lowered its fiscal 2025 EPS range $3 below estimates at just $12.80.

COMPANY NEWS

When Memes Come True. Murdoc Family Completes Succession Season Finale IRL

Fox shares were falling after the end of the Rupert Murdoch succession drama that inspired the famous and regularly memed TV show of the same name.

The Murdoch family has agreed: Lachlan Murdoch will take control of the family business, while three siblings, Prudence, Elisabeth, and James, exit with $1.1B a piece. Two younger sisters, Grace and Chloe, are also included in the Lachlan family trust that now holds the controlling stake in Fox and News Corp.

Rupert and Lachlan had sued the three to force them out of decision-making power over the media empire. $FOX ( ▼ 3.58% ) shares fell, using 37M shares as collateral for a loan payout, alongside 30M shares from $NWS ( ▲ 0.85% ), that was also on its way down.

POPS & DROPS

Top Stocktwits News Stories 🗞

Nebius surged 42% after $17B Microsoft AI deal.

Alibaba rose 34% after a raise from Barclays.

UnitedHealth jumped 8% after strong Medicare plan forecast.

Talon Capital dipped 0.2% on Nasdaq debut at $9.98.

Cracker Barrel paused restaurant remodels after logo backlash.

Ondas fell 13% after $200M stock offering.

Gemini secured $50M from Nasdaq ahead IPO.

Tourmaline Bio jumped 58% after $1.4B Novartis acquisition.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

IN PARTNERSHIP WITH THE CMT ASSOCIATION

Dubai Awaits: Attend The CMT Association’s Global Investment Summit 🌍

The Global Investment Summit 2025 brings together some of the brightest minds in finance — from market pioneers to global strategists. Don’t miss the chance to learn directly from experts shaping today’s markets through high-impact panel discussions, technical analysis skill workshops, and exclusive networking opportunities.

It’s all happening at Dubai’s iconic Museum of the Future from September 30 to October 2. The CMT Association is offering a special discounted rate exclusively for the Stocktwits community. Register below—and we’ll see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

PRESENTED BY STOCKTWITS

SPY’s Wall of Worry, China’s Monthly Breakouts, and FUBO’s Cult Chart

Daily Rip Live with Katie Perry, Jake Wujastyk, and Olivia “Voz” Vosnenko. Today’s show mixes fresh setups with market vibes: is SPY toppy or just climbing the wall of worry, what the China trio BABA, JD, PDD is signaling on higher timeframes, whether FUBO’s cult chart is worth the stress, and why ONDS’s lightning-fast 5 dollar offering might actually be bullish. We also hit Wheels Up UP, ALAB, VFC, gold’s highs, the upcoming Apple event, and a quirky dating-spend stat.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: PPI (8:30 AM), Crude Oil Inventories (10:30 AM), 10-Year Note Auction (1:00 PM), Atlanta Fed GDPNow (1:00 PM), Federal Budget Balance (2:00 PM)📊

Pre-Market Earnings: Chewy ($CHWY) and Amber International ($AMBR) 🛏️

After-Market Earnings: Vince Holding ($VNCE) and Lesaka Technologies ($LSAK) 🌕

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋