Presented by

The Weekend Rip

Happy Weekend!

The market was dominated by the Fed's rate cut, which sent small caps and the Dow soaring to new highs but left major tech stocks questioning their ability to actually build the AI infrastructure. Meanwhile, the corporate world went deal-crazy, with Paramount escalating a $108B hostile bid for Warner Bros., Nvidia facing a new China tax that let’s them ship higher-end chips, and Disney trading $1 billion for the right to make AI-generated videos of Mickey Mouse.

Let's recap and prep you for the week ahead. 📝

Monday 🤯: The market slid while waiting on the Fed's rate cut decision, as the great Warner Bros. deal got even more ridiculously dramatic with Paramount upping its hostile bid to $108B using Middle East money and the help of friends in high places. Adding to the intrigue, Trump announced Nvidia can finally sell its powerful H200 chips to China, but only if the U.S. gets a 25% cut of the revenue, turning the chip export ban into a bizarre tax revenue stream.

Tuesday 😴: The market was barely awake on the eve of the expected Fed rate cut, moving slowly as job openings ticked up but major financial players like JPMorgan pre-emptively hiked their expected expenses by 10% for the AI and credit wars ahead. Meanwhile, the meme stock retirement home saw GameStop and Cracker Barrel both disappoint on earnings, which for the latter, not even returning "Old Timer" to its logo could fix.

Wednesday 💃: The market threw a party after the Fed finally delivered the universally anticipated rate cut, sending small caps and the Dow flying toward all-time highs. However, the celebration was cut short by the chaotic "Dot Plot," which featured three official dissents and a wildly split committee that couldn't agree on the next move, meanwhile, Oracle fell 10% because investors were skeptical it could actually build enough cooling racks to deliver on its massive AI deals.

Thursday 🏗️: The Dow and Russell hit record highs, but big tech was left behind as the market got cold feet about the sector's ability to fulfill its massive AI construction promises, evidenced by Oracle sinking after a decent report. Even Broadcom's earnings blowout and 74% surge in AI chip revenue didn't convince exhausted investors, who seemed to prefer the drama of Lululemon's CEO stepping down and the absurdity of Disney trading $1 billion for the right to churn out AI slop videos of Mickey Mouse.

Friday 😴: The market took a much-needed breath after Thursday's record highs, with tech stocks staying in the red as investors continued to question if the sector can actually build the data centers it's promising. Even though Broadcom shattered earnings and reported a massive 74% surge in AI chip revenue, the stock was down because, apparently, a great report is still not "fireworks" enough for the AI-obsessed crowd.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

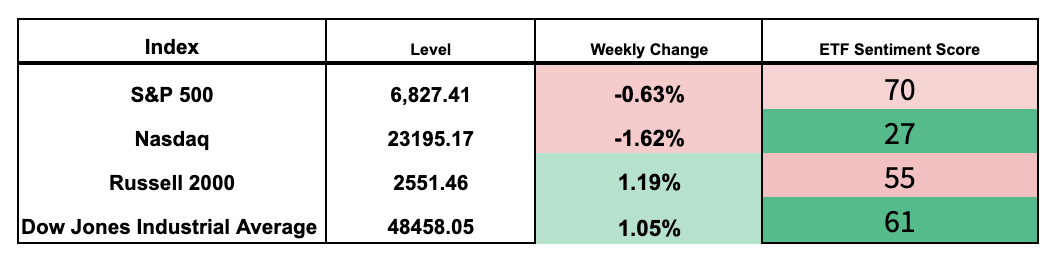

Here are the closing prices:

SPONSORED

🚨 BREAKING: Polymarket early access is now live in the US 🇺🇸

Polymarket, the world's largest prediction market, is giving Daily Rip users early access to the most anticipated app launch of 2025.

Now live in all 50 states, Daily Rip readers can get $10 credit on us to try Polymarket.

Skip outrageous sportsbook fees and trade directly on outcomes you believe in. With more markets coming soon, you can now trade with ultra low fee on the NFL, NBA and more…

0.01% Fee: save the 2-8% sportsbook fees by trading peer-to-peer 💰

Cash Out Anytime: sell your position pre-game or in-game at the current price 📈

No House: so you never get kicked out for winning ✅

Sign up today and get your first $10 to trade for free (no deposit required) with code DAILYRIP 🇺🇸

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

SPONSORED

Fire ALL Your Other Trading Tools - Replace Them with TrendSpider

TrendSpider is more than just charts. It is a complete ecosystem designed to make you a smarter, faster, and more efficient trader.

Stop switching between apps. Replace your standalone charts, scanner, backtester, and options flow tool with one platform. Access robust fundamentals, insider trading data, and government trade tracking alongside institutional-grade technicals, all in one place.

Get ready for 2026. Join the Holiday Pre-Sale to lock in up to 68% off. Plus, get 1 year of SignalStack Premium, 6 months of a premium indicator, and 1 month of Sidekick Plus. That is over $1,000 in free upgrades when you start now.

3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋