OVERVIEW

The Weekend Rip: February 23, 2025

Source: Tenor.com

It was a volatile week in the markets, with stocks moving around on earnings and macro concerns. 😬

Let's recap and prep you for the week ahead. 📝

What Happened?

📆 On Monday, U.S. markets were closed for President’s Day.

🪙 On Tuesday, investors searched for value at all-time highs, with Nike and Intel turnaround stories taking hold. Crypto was hit by LIBRA’s $4.5 billion rug pull, Baidu boomed after earnings, and IQ slumped.

💊 On Wednesday, Hims & Hers Health stole the show after announcing a major acquisition. Carvana crashed despite crushing earnings, and Fiverr, SolarEdge, and Etsy moved sharply following their quarterly results.

⚠ On Thursday, Celsius soared after outlining an acquisition and plan to reignite growth. After reporting results, Alibaba, Walmart, Unity, and Jumia saw major moves, with Walmart’s warnings around tariffs hitting the consumer segment hard.

🤮 On Friday, the market fell ill over virus concerns, which put healthcare stocks on center stage. The Department of Justice is investigating UnitedHealth Group’s Medicare billing practices, Hims & Hers tumbled, and BlueBird Bio took a buyout. Plus, it was a frisky Friday in crypto following a $1.4 billion hack.

🤩 This week's Stocktwits Top 25 showed underperformance vs. the major indexes.

Here are the closing prices:

S&P 500 | 6,013 | -1.66% |

Nasdaq | 19,524 | -2.51% |

Russell 2000 | 2,195 | -3.72% |

Dow Jones | 43,428 | -2.51% |

Bullets From The Weekend 📰

😡 Homebuilder confidence falls as rates stay near 7%. The average 30-year fixed-rate mortgage was below 7% for the fifth straight week, but homebuilder confidence remains subdued. Supply remains constrained, keeping prices high in most major markets. With affordability low, the steady labor market and the economy humming, the housing market lacks a catalyst to drive activity. Yahoo Finance has more.

📉 The office-to-apartment conversion trend continues. The pipeline for new apartments in old offices continues to expand. However, developers completed less than 7% of conversions underway in 2024 due to the time, money, and government approvals needed for them to succeed. New York remains the hottest market, with a 59% YoY unit change, followed by Washington, Los Angeles, Chicago, and other major city centers. More from Axios.

☢ HP’s Humane acquisition causes some fallout. The hardware startup that had most of its assets acquired by HP for $116 million is immediately discontinuing sales of its $499 AI Pins and discontinuing use of these devices. It offers customers who have bought the device in the last 90 days a refund. As for employees, some received job offers from HP, but many others who worked closer to the AI Pin devices are out of a job. TechCrunch has more.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

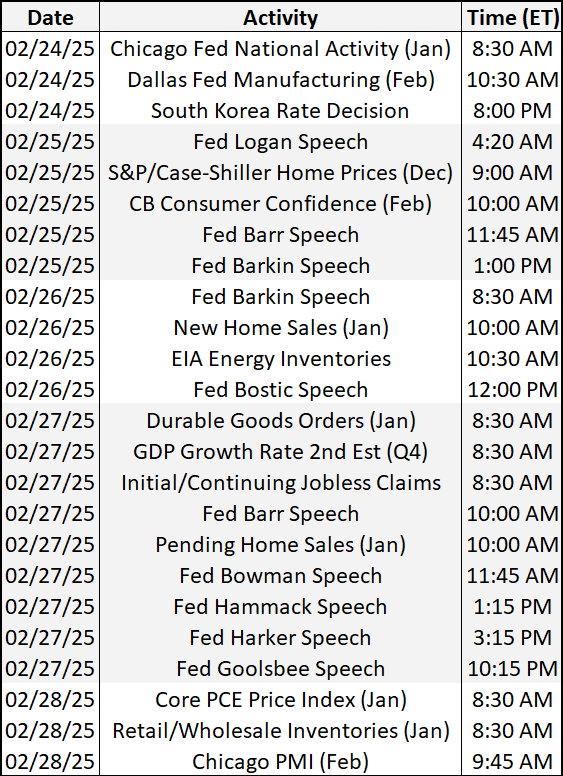

Economic Calendar

Source: TradingEconomics

It’s a busy week of economic data, with investors focused on housing and inflation data. In addition to the above, check out this week's complete list of economic releases.

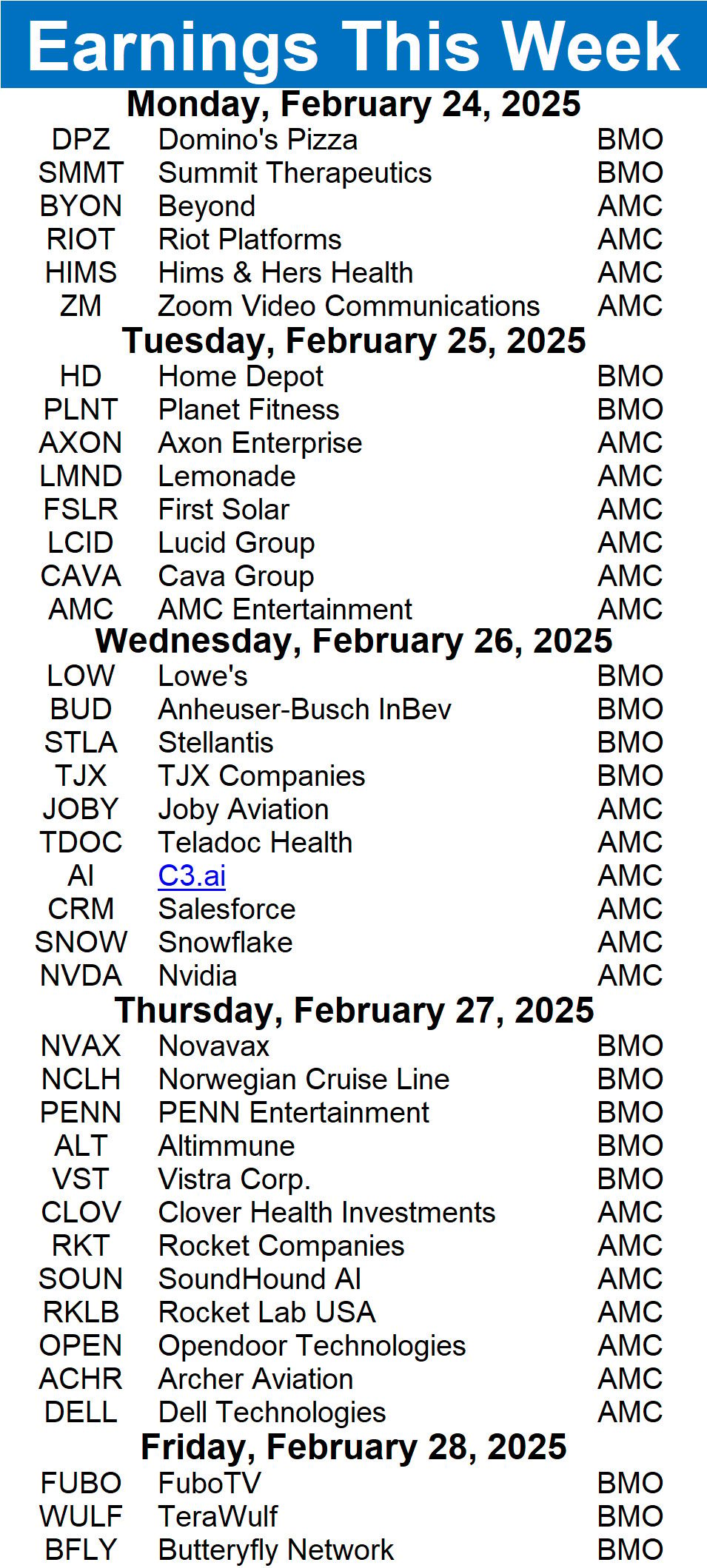

Earnings This Week

Earnings season is in full swing, with roughly 722 companies reporting this week.

Source: Stocktwits

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋