The Weekend Rip

Happy Weekend

It was the second red trading week in a row, and it feels like a theme that short weeks are bad for the market this year. It was the first full week of air combat between Israel and Iran, which shook markets and bolstered energy prices. Saturday, President Trump inserted himself and the U.S. into the conflict, carrying out strikes on Iranian nuclear facilities. It is unclear where the violence will escalate next, though Iranian military sources said there was a big bullseye painted on the newly arrived U.S. aircraft carrier strike group that picked up the B2 bombers on their exit from Iranian airspace Saturday night.

It’s also the first full week of China and the U.S. playing along to a new (old) trade agreement tune. Finally, it was a rate decision week, but the FOMC came right out and said, ‘We are not going to work this summer, at least not till July.’ Maybe the coming week’s PCE inflation numbers will change their tune. 📉

Let's recap and prep you the best we can for the week ahead. 📝

◀ On Monday, Trump reaffirmed his commitment to tariffs at the G7 summit, at least for the day, as world leaders sought clarity on U.S. trade policy ahead of the self-imposed July 9 deadline. Senator Tim Kaine introduced a resolution aiming to limit Trump's ability to launch military strikes against Iran without congressional approval (it didn’t work.) EU negotiators are reportedly considering a 10% tariff deal with the U.S. to avoid higher levies on cars, pharmaceuticals, and electronics, though officials stress the offer is conditional.

🌏 On Tuesday, the S&P 500 dipped back below 6,000 as rising tensions between Iran and Israel weighed on sentiment and Trump left the G7 summit early to ponder joining another Middle East war this century. May retail sales were weaker than expected, reflecting tightening consumer behavior under tariff pressure. Solar stocks were hit hard after the Senate tax bill proposed phasing out clean energy credits by 2028, while JetBlue slumped on a gloomy 2025 outlook that dragged down the airline sector.

⚡ On Wednesday, the Federal Reserve held interest rates steady at 4.25%–4.5%, with the latest dot plot showing policymakers still expect two cuts this year, though seven officials forecast no change. Markets briefly rallied on the decision before reality sank in—tensions in the Middle East remain high, FOMC inflation expectations for 2026 rose, and new tariffs could emerge. Coinbase jumped over 4% as the Senate passed the GENIUS Act and the firm unveiled Coinbase Payments, enabling businesses to accept USDC transactions.

🐂 On Thursday, U.S. markets were closed for the Juneteenth holiday, but global sentiment leaned risk-off. Futures hinted at a cautious tone heading into Friday’s session, which features a “Triple Witching” expiration—when stock index futures, options, and individual equity options all expire simultaneously. This quarterly event often stirs volatility. Meanwhile, Cem Karsan joined the Stocktwits Weekend Rip team to break down the market.

😢 On Friday, trading wrapped up for a short and volatile week that ended in a market decline. Federal Reserve Governor Christopher Waller opened the session with a hopeful signal of a possible rate cut as soon as July, but investor nerves frayed as reports emerged about the U.S. considering tighter chip tool export restrictions to China. Tesla watchers braced for Sunday’s launch of its self-driving ride-hailing pilot in Austin.

Saturday, this week's Stocktwits Top 25 showed the week’s top movers, and the U.S. military carried out Operation Midnight Hammer on the Iranian Nuclear Program.

Here are the closing prices:

S&P 500 | 5,967 | -0.15% |

Nasdaq | 19,447 | +0.21% |

Russell 2000 | 2,109 | +0.42% |

Dow Jones | 42,206 | +0.02% |

SPONSORED

Why 50,000+ Investors Are Backing BOXABL's Vision

You may have heard about BOXABL and their mission to revolutionize the outdated construction industry. BOXABL is bringing assembly-line automation to home building, much like Henry Ford did for cars.

Here's a quick recap of why we believe BOXABL is poised for massive disruption:

Homes built differently: BOXABL homes are manufactured in our Las Vegas factory, folded for transport, and then unfolded on-site in just an hour.

BOXABL milestones:

Delivered a prototype order to SpaceX in 2020.

Project order for 156 homes from the DoD completed in 2021.

Built over 700 homes to date.

Actively delivering to both developers and individual consumers.

Reserved the Nasdaq ticker symbol $BXBL!

Raised over $200 million from over 50,000 investors since 2020.

BOXABL’s crowdfunding round will close on June 24th. This is your opportunity to invest in BOXABL's offering at just $0.80 per share.

Disclosure: This is a paid advertisement for BOXABL’s Regulation A offering. Please read the offering circular here. This is a message from BOXABL Reserving a Nasdaq ticker does not guarantee a future listing on Nasdaq or indicate that BOXABL meets any of Nasdaq's listing criteria to do so.

3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

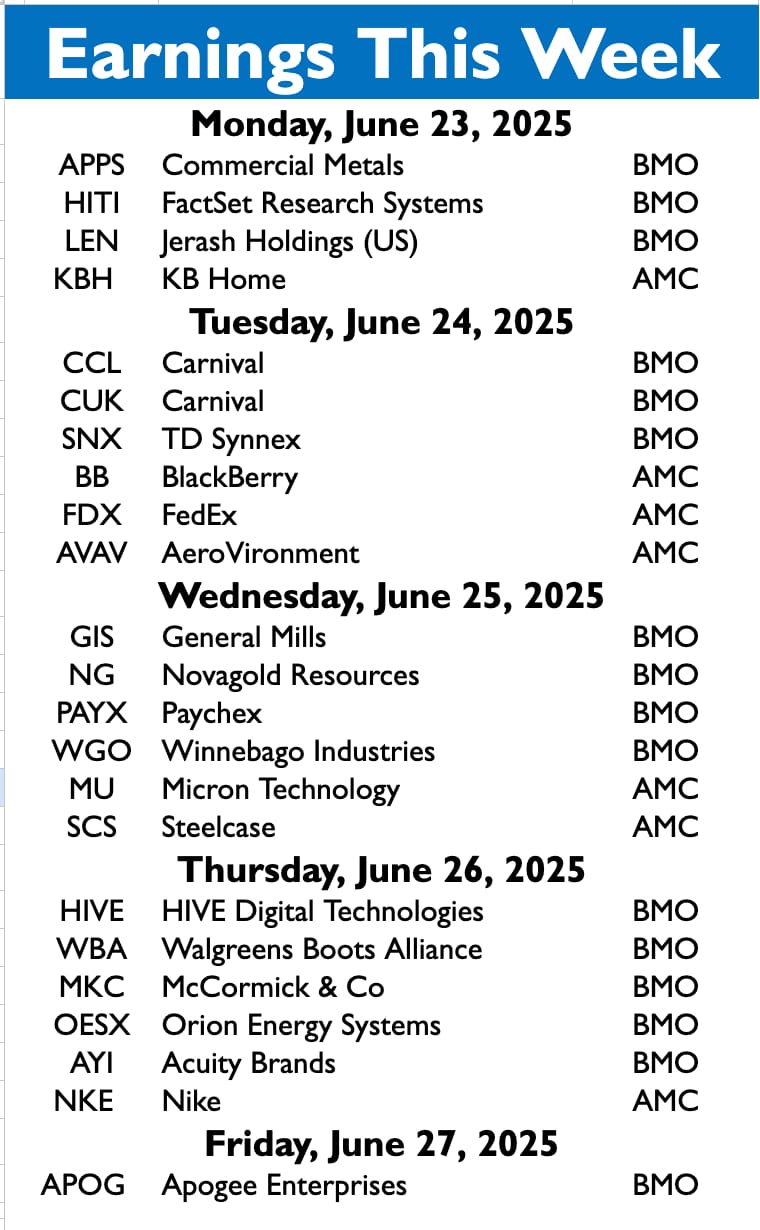

Earnings This Week

The Spring earnings season is dead and buried, with just 58 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on PCE inflation data, and Fed Reserve member speeches.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

🕔 Iran says it reserves all options after ‘outrageous’ U.S. strikes, launches fresh attacks on Israel

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋