OVERVIEW

The Weekend Rip: June 30, 2024

Stocks closed out another quarter of gains, with big tech doing most of the work. The trillion-dollar question remains whether that trend will continue into the year's second half or if the market will find new leadership. 🤔

Let's recap and prep you for the week ahead. 📝

What Happened?

💸 On Monday, money rotated from tech to the rest, with Nvidia and other chip stocks selling off. Bitcoin cracked amid concerns over Mt. Gox supply, dragging crypto with it. And it was another busy day of M&A activity.

🤖 On Tuesday, the market flipped on its head, with tech leading and the rest falling. FedEx jumped to three-year highs after its revenue picture improved, and Carnival Cruise said the consumer is continuing to spend. Beaten-down EV maker Rivian soared after getting a lifeline from Volkswagen.

🤑 On Wednesday, Amazon joined the $2 trillion market cap club as money moved from tech leaders to tech laggards. At the company's first shareholder meeting, Nvidia’s CEO outlined major AI plans while other chip stocks slumped.

🐶 On Thursday, investors had lots to chew on after Roaring Kitty’s return sent Chewy and other dog-related stocks soaring. Nike is the latest consumer brand to struggle with demand, with Walgreens also plummeting in earnings. And the IRS issued a rare apology.

🗓️ On Friday, stocks closed out another quarter of gains as investors debated the Presidential debate, inflation numbers, and the SCOTUS decision that kneecapped federal regulators.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $CHWY, $SEDG, $ALT, $DJT, $CMG, and $FFIE.

Here are the closing prices:

S&P 500 | 5,460 | -0.08% |

Nasdaq | 17,733 | +0.24% |

Russell 2000 | 2,048 | +1.27% |

Dow Jones | 39,119 | -0.08% |

Bullets From The Weekend

🎯 SEC picks a new target in the crypto space, DeFi apps. The Securities and Exchange Commission (SEC) finally issued its complaint against Consensys, the maker of the MetaMask crypto Wallet. The suit labels a wider group of crypto tools as securities, specifically aiming at services that enable people to swap or stake coins. The agency also alleges Consensys broke laws by offering and selling “securities” from staking providers Lido and Rocket Pool. Axios has more.

🎬 Redbox’s owner finally files for bankruptcy after repeatedly missing payments. Chicken Soup for the Soul Entertainment hasn’t paid its employees in over a week and owes money to almost everyone in Hollywood. It informed employees of its bankruptcy filing late Friday evening after finally crumbling under the nearly $1 billion in debt on its balance sheet. Roughly a third of that is new financing it took on to acquire Redbox in 2022. More from The Verge.

🚫 Amazon hires founders away from a prominent AI startup. Adept, which was developing AI-powered “agents” to complete software-based tasks, has agreed to license its tech to Amazon and have its founders (and a portion of its team) join Amazon as employees. With that said Adept is not closing up shop. Instead, its head of engineering, Zach Brock, will take over as CEO and refocus its efforts on “solutions that enable agentic AI.” TechCrunch has more.

STOCKTWITS & 11thESTATE PARTNERSHIP

Effortlessly Find & Claim Shareholder Settlements 🕵️

In 2023, public companies settled a whopping $8.1 billion with investors. However, 75% of shareholders haven't claimed their payouts!

Even now, Apple, Alphabet, Zoom, and 50 other companies are distributing settlements to investors. Yet, most people either don’t know about these settlements or prefer not to spend time on the paperwork.

11thEstate identifies relevant settlements and recoveries, handles all the paperwork, and delivers the payouts to your account.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

It’s a short but busy week of economic data, with investors focused on the FOMC Minutes and employment day. In addition to the above, check out this week's complete list of economic releases.

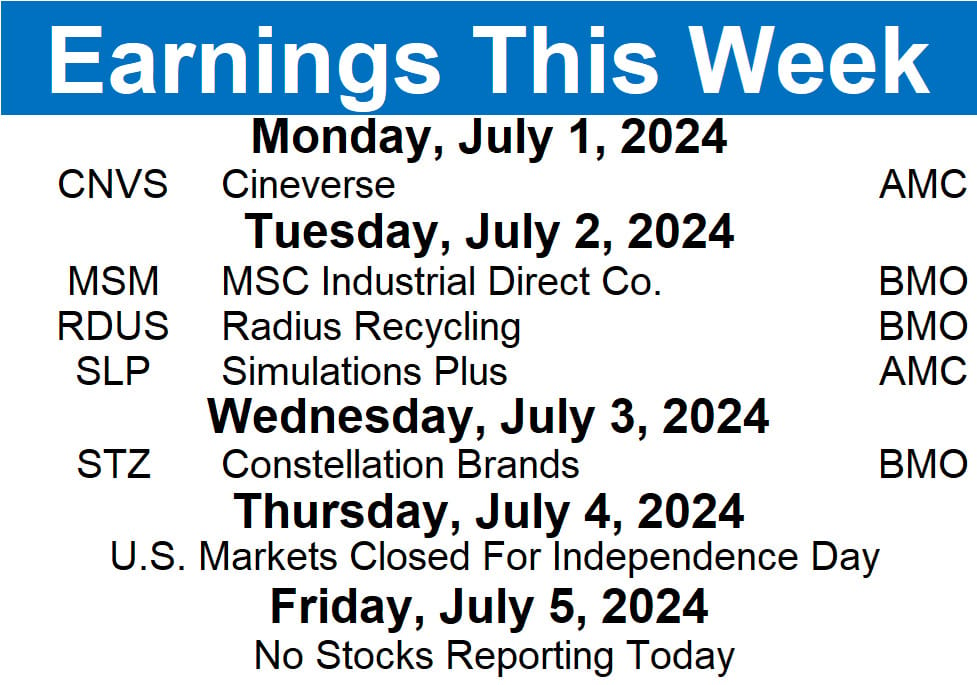

Earnings This Week

Earnings season is basically nonexistent, with 5 stocks reporting this week. Some tickers you may recognize are $STZ, $CNVS, $SLP, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍