The Weekend Rip

Happy Weekend!

It’s my B day, so happy B day to my twins out there

Markets pulled back this week as tech stocks faced skepticism over AI spending and consumer sentiment hit its lowest since 2022. The government shutdown reached a record 37 days, triggering FAA flight cuts and partisan gridlock, while earnings reactions ranged from Expedia’s surge to Sunrun and Opendoor’s sharp declines. Tesla slipped despite shareholder approval of Elon Musk’s $1T pay package, and the Nasdaq posted its worst week since April.

Let's recap and prep you for the week ahead. 📝

🦇 Monday — Palantir posted its 21st straight revenue beat with 63% YoY growth and raised full-year guidance, but shares traded flat as investors weighed its lofty 85× sales multiple. Amazon surged on a $38B Nvidia chip deal to power OpenAI’s datacenter ambitions, while Cipher Mining and Iren inked multibillion-dollar GPU infrastructure deals. Meanwhile, Kimberly-Clark announced a $40B buyout of Tylenol-maker Kenvue, and Berkshire Hathaway revealed record cash reserves but no buybacks, leaving investors cautious.

🔥 Tuesday — Markets climbed as Nvidia hit $4.65T and Microsoft crossed $4T on blockbuster AI deals—Nvidia with Uber and Lucid, Microsoft with OpenAI. The S&P 500 broke 6,900 ahead of the Fed’s rate decision, with traders pricing in a cut despite limited data from the shutdown. Visa beat earnings, Enphase guided lower, and EA suspended guidance amid a $55B go-private deal.

🫂 Wednesday — Markets climbed as ADP data showed 42,000 new jobs in October, offering rare clarity amid the shutdown. IonQ surged on a 221% revenue spike, Robinhood beat on crypto-fueled earnings, and Duolingo posted strong results despite slowing user growth. Snap rallied on a $400M AI deal with Perplexity, while Qualcomm, ARM, and AppLovin beat earnings but faced mixed reactions.

🤼 Thursday — Markets fell as October layoffs surged 183% month-over-month, marking the worst jobs cut tally in two decades. Tesla shareholders approved Elon Musk’s $1T pay package, while DraftKings disappointed on guidance despite landing ESPN as its official sportsbook partner. Datadog soared on strong AI-driven earnings, but e.l.f. Beauty and Block sank on margin pressure and missed estimates.

📰 Friday — Markets wobbled Friday before closing slightly green, as the S&P 500 dipped below its 50-day moving average and consumer sentiment hit its lowest since 2022. The government shutdown reached a record 37 days, with FAA flight cuts looming and partisan gridlock intensifying after a rejected healthcare extension deal. Tech stocks pulled back sharply on AI spending skepticism, while earnings reactions were mixed—Expedia soared, Sunrun and Opendoor sank, and Tesla slipped despite Musk’s $1T pay package approval.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

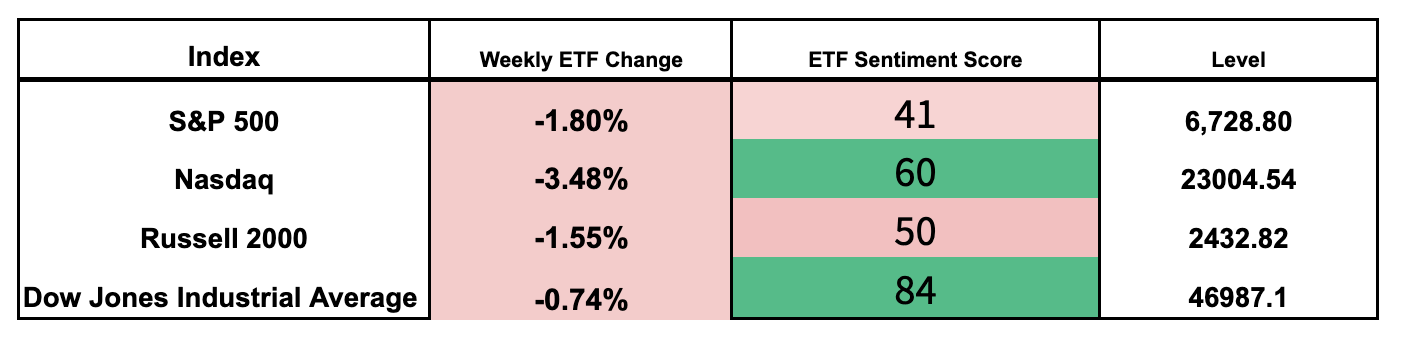

Here are the closing prices:

SPONSORED

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Earnings season is chugging along, with over 713 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋