Presented by

The Weekend Rip

Happy Weekend!

Markets swung through highs, dips, and rebounds this week as AI megadeals, Fed caution, and geopolitical drama dominated headlines. Nvidia’s $100B OpenAI chip deal kicked off Monday’s rally, while Eric Jackson’s BETR pick sparked meme stock mania. Lithium Americas and Opendoor surged midweek on stake news and housing data, but Powell’s remarks cooled sentiment. Trump signed off on the TikTok takeover Thursday, and Friday’s inflation data reassured investors that rate cuts are still on track.

Let's recap and prep you for the week ahead. 📝

◀ Markets hit fresh highs Monday, driven by Nvidia’s $100B OpenAI chip deal and Eric Jackson’s viral endorsement of Better Home & Finance, which doubled intraday as traders dubbed it the next OpenDoor. Tech led gains while Kenvue plunged to record lows after President Trump linked Tylenol to autism in a controversial NIH directive. Meanwhile, Disney faced backlash over Jimmy Kimmel’s suspension, and Plug Power, Office Depot, and Metsera all surged on bullish news and buyouts.

🌏 Markets cooled Tuesday as Powell’s cautious Fed remarks and Trump’s fiery UN speech weighed on sentiment, despite strong earnings from Micron and a surge in lithium and defense stocks. Lithium Americas soared on reports of a U.S. stake in its Thacker Pass mine, while BigBear.ai rallied on a Navy partnership and retail traders doubled down on Eric Jackson’s BETR pick. Fed officials warned of labor risks and stagflation, and Trump hinted at a policy shift on Ukraine while urging NATO to confront Russian aggression.

⚡ Markets dipped Wednesday as investors paused after Tuesday’s highs, digesting Powell’s cautious remarks and Yardeni’s warning of “irrational exuberance.” Lithium Americas surged on news of a potential U.S. stake in its Thacker Pass mine, while Opendoor climbed after Jane Street revealed a $361M position and new home sales hit a three-year high. Robinhood rallied on FINRA’s plan to ease day trading rules, and Alibaba jumped 9% after pledging $50B to AI, joining a wave of mega-cap handshake deals across tech.

🐂 Markets slipped Thursday despite upbeat GDP and jobless data, as investors digested Trump’s Oval Office signing of the TikTok takeover deal and warnings from Citadel’s Ken Griffin about government stake-picking. The $14B TikTok valuation gives the U.S. a 45% stake, with Oracle providing cloud infrastructure, pending China’s approval. Costco beat earnings on strong membership growth, while CarMax missed as used car sales slumped, and PepGen surged 121% on DM1 trial data.

😢 Markets rebounded Friday after inflation data showed prices rising but not enough to derail the Fed’s rate cut path, with every sector closing green despite fresh tariff threats. Trump proposed a 100% duty on drugs not manufactured in the U.S., boosting healthcare stocks, and chipmakers were offered exemptions if they match domestic output. EA surged on reports of a $50B buyout led by Silver Lake and Saudi Arabia’s Public Investment Fund, while a looming government shutdown and OpenAI’s $100B week kept macro tensions high.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,643 | -0.31% |

Nasdaq | 22,484 | -0.65% |

Russell 2000 | 2,434 | -0.59% |

Dow Jones | 46,247 | -0.15% |

SPONSORED

Kara Water: Round Closes Soon!

With over $2M raised and 14,000+ reservations across Kara Water products, investors now have the opportunity to secure equity in the company redefining how the world drinks water. Round closes on October 16th 2025 at 11:59 PST.

Sponsorship Disclaimer: This Reg CF offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Earnings season is chugging along, with just 33 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

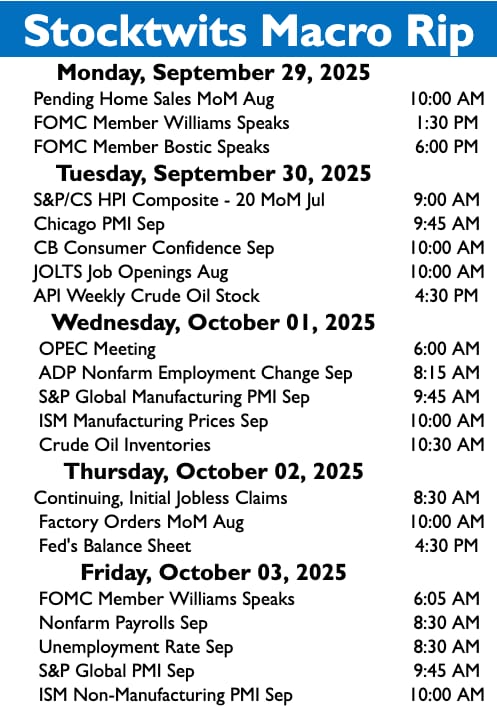

Economic Calendar

It’s a busy week of economic data, with investors focused on unemployment data.

In addition to the above, check out this week's complete list of economic releases.

IN PARTNERSHIP WITH MONEYSHOW

Join Stocktwits Editor-in-Chief Tom Bruni At The Orlando MoneyShow, October 16-18 🧑🏫

Hey all, Tom Bruni here! I’m joining our friends at the Orlando MoneyShow this October. I’ll cover how to use Stocktwits sentiment to navigate risks and find opportunities in the market. Plus, hear from dozens more experts during this three-day event. Register below and we’ll see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋