OVERVIEW

The Weekend Rip: June 16, 2024

It was another week of all-time highs for the large-cap S&P 500 and Nasdaq 100 as investors digested tech earnings and the Fed’s economic projections.

Let's recap and prep you for the week ahead. 📝

What Happened?

🤖 On Monday, Apple’s WWDC event touted an AI future, but initial reactions were mixed at best. Meanwhile, the S&P 500 index (and its peers) announced their latest shakeups, snubbing Dell and Palantir.

🍏 On Tuesday, Apple put the haters in their place, rallying sharply to new all-time highs and reclaiming its spot atop the market. Meanwhile, Oracle’s AI deals with Google and OpenAI boosted the stock significantly, as the major averages closed mixed.

📈 On Wednesday, the Fed’s dot plot reiterated a “data-dependent” stance and indicated just one rate cut is likely in 2024. Meanwhile, Broadcom jumped on the AI and stock split trend, soaring to fresh all-time highs on the news. And the major averages closed deeply in the green.

📊 On Thursday, the S&P 500 and Nasdaq 100 made new all-time highs on the back of big tech’s strength. Adobe joined the AI hype list along with book publisher John Wiley & Sons, while SEC Chairman Gary Gensler provided an update on Ethereum ETF applications.

⚠️ On Friday, large-cap tech was the only bright spot as investors scooped up the latest artificial intelligence IPO. However, investors and traders remain concerned about market breadth as the divergence between the S&P 500 and its equal-weighted counterpart continues.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $SOFI, $JMIA, $NVAX, $GME, $AAPL, and $MSOS.

Here are the closing prices:

S&P 500 | 5,432 | -0.04% |

Nasdaq | 17,689 | +0.12% |

Russell 2000 | 2,006 | -1.01% |

Dow Jones | 38,589 | -0.15% |

Bullets From The Weekend

⚒️ Serbia to give green light for major lithium mine. Reports are that Serbian President Aleksander Vicic is preparing to give Rio Tinto approval to develop Europe’s largest lithium mine about two years after calling off the project. New guarantees from the mining giant and European Union have quelled regulators’ fears about environmental standards being met. The goal is to open the mine in 2028, producing 58,000 tons of lithium annually, which would be enough for 17% of EV production in Europe (1.10 million vehicles annually). Reuters has more.

🤔 Tech giants attempt to find an AI icon that makes sense. When we open our phones, we know which icons represent our favorite apps; it’s part of the branding and marketing that keeps us hooked. However, tech giants everywhere are rolling out their artificial intelligence (AI) apps and searching for the perfect symbol to represent AI. Based on the collection of options currently on the market, it’s clear no company has cracked the code yet. More from TechCrunch.

💰 Hyundia’s India IPO could be the largest ever. The automaker is seeking regulatory approval to list in Mumbai, which could see the South Korean parent sell a stake of up to 17.50% in the company. It would be the first car maker to go public in two decades since Maruti Suzuki, as the company looks to capitalize on the Indian stock market’s recent bull run. Hyundai will look to raise $2.50 to $3.00 billion at a valuation of up to $30 billion Reuters has more.

STOCKTWITS “TRENDS WITH FRIENDS”

Investing Is The Professional Sport For Thinkers 🧠

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

This week, they’re joined by entrepreneur and tech investor Anthony Pompliano (AKA Pomp) to discuss: the degenerate economy, the difference in mindset between NYC and Miami, crypto’s mainstream adoption, and more!

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

There’s a lot of random economic data this week, with investors focused on Fed member speeches and housing data. In addition to the above, check out this week's complete list of economic releases.

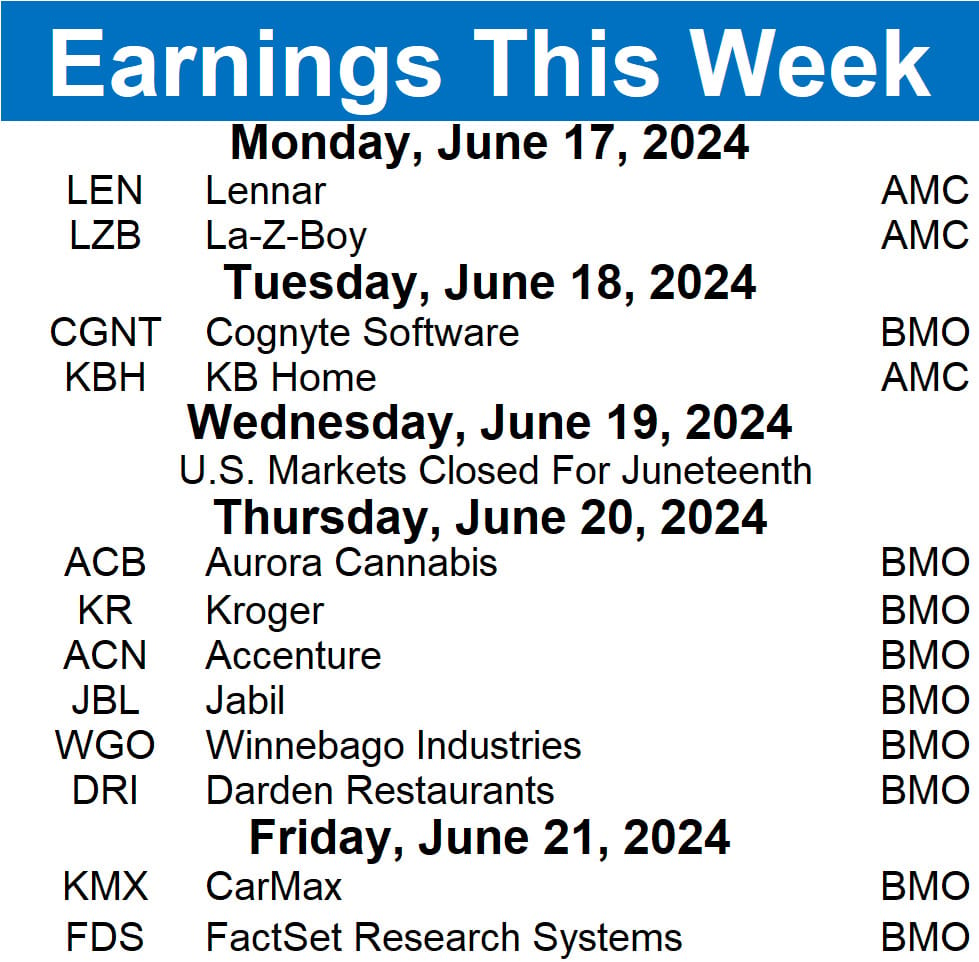

Earnings This Week

Earnings season has crawled to a halt, with 25 stocks reporting this week. Some tickers you may recognize are $LEN, $KBH, $DRI, $ACN, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍