OVERVIEW

The Weekend Rip: June 23, 2024

It’s the final week of the quarter, with investors and traders looking to close out strong and position themselves for the second half of the year. ⌛

Let's recap and prep you for the week ahead. 📝

What Happened?

📈 On Monday, stocks continued higher after another big tech breakout. Meme stocks tumbled again after GameStop’s annual shareholder meeting left investors without any answers, and AMC’s highest-grossing weekend of 2024 failed to boost the stock.

👑 On Tuesday, Nvidia became the most valuable company by market capitalization. Meanwhile, Fisker Automotive filed for bankruptcy, and Trump Media and Technology fell after filing to sell over 14 million more shares. Silver found support along with the rest of the metals’ complex.

🗓️ On Wednesday, U.S. markets were closed for the Juneteenth holiday while crypto continued its slow slide lower.

⚠️ On Thursday, stocks snapped their seven-day winning streak after Nvidia and the semiconductor sector reversed. Darden Restaurants warned that consumers continue to pull back on discretionary spending, while Jabil warned of a slowdown in certain sectors of the tech market. On the other hand, consulting firm Accenture forecasted a major AI boost.

🔺 On Friday, semi stocks pressured the major indexes, which managed to eke out a small weekly gain. The affordability crisis is not unique to housing, with CarMax showcasing similar conditions in the used car market. AMC looked to lengthen its runway by working with creditors to renegotiate debt terms. Lastly, several boring stocks also started breaking out

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $GME, $HIMS, $HOLO, $PLTR, $DELL, and $ASTS.

Here are the closing prices:

S&P 500 | 5,465 | +0.61% |

Nasdaq | 17,689 | +0.00% |

Russell 2000 | 2,022 | +0.79% |

Dow Jones | 39,150 | +1.45% |

Bullets From The Weekend

😡 AI companies continue to scrape websites despite efforts to block them. The latest company to come under fire is Perplexity, which describes itself as a “free AI search engine.” Forbes accused it of stealing its story and republishing across multiple platforms. Wired also reported that Perplexity had ignored the Robots Exclusion Protocol (robots.txt) and scraped its website data. Several other media giants have accused it of the same behavior. Engadget has more.

₿ Crypto industry does a full-court press ahead of Ethereum ETF rollout. Two providers of digital-asset ETFs just launched advertisements to bring the promise of the Ethereum blockchain to the masses. Bitwise officially launched campaigns on mainstream TV networks, as well as social sites like Reddit and YouTube. VanEck also rolled out its own ad as the industry’s largest players look to keep the mainstream momentum going. More from Axios.

🚫 U.S. proposes rules to stop Americans from investing in certain Chinese tech. The Treasury Department is fleshing out a proposed rule restricting and monitoring U.S. investments in China for AI, computer chips, and quantum computing. It stems from an August 2023 executive order regarding “countries of concern” and their access to American dollars that fund advanced tech for military, intelligence, surveillance, and cyber uses. AP News has more.

STOCKTWITS CONTENT

Discover New Trade Ideas With “Chart Art” By Stocktwits

We launched “Chart Art” to curate the best analysis and trade ideas from the Stocktwits community. And so far, thousands of readers have enjoyed discovering new ideas and Stocktwits users to follow each day.

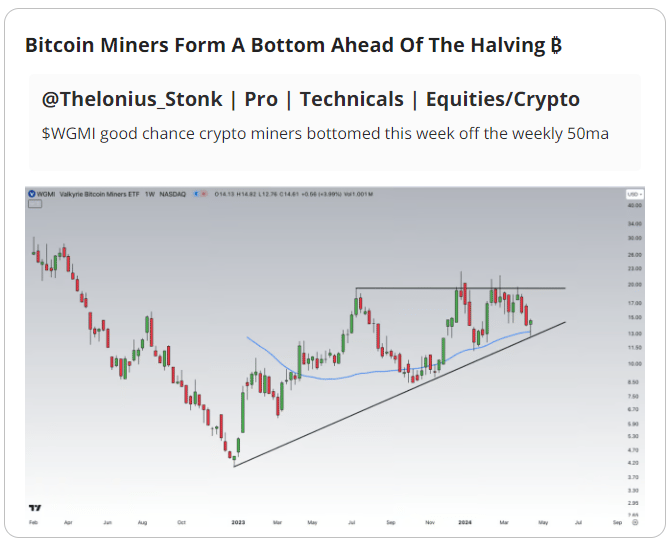

Like this idea shared by Stocktwits user @Thelonius_Stonk and featured in Chart Art ahead of Bitcoin miners’ 40% rally over the last two months!

There is so much great content happening on Stocktwits, and it’s our job to help you find it. If you want to join thousands of other traders and investors receiving our “Chart Art” email every evening by 8 pm ET, click here.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

There’s a lot of random economic data this week, with investors focused on housing market data and Friday’s inflation read. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season has crawled to a halt, with 39 stocks reporting this week. Some tickers you may recognize are $MU, $NKE, $FDX, $CCL, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍