OVERVIEW

The Weekend Rip: May 19, 2024

Stocks made new all-time highs this week amid the meme stock madness, though commodities were the belle of the ball as metals soared. 📈

Let's recap and prep you for the week ahead. 📝

What Happened?

🙀 On Monday, Roaring Kitty reignited the meme stock mania, with the major indexes closing mixed and commodities remaining on traders’ radars as orange juice futures hit new highs.

🤖 On Tuesday, the major indexes pushed higher as we covered the fundamentals of meme stocks. Alibaba had a bad earnings day, and the semiconductor sirens called traders back again.

🥳 On Wednesday, the U.S. stock market indexes made new all-time highs, with utilities surprisingly leading the YTD sector gains. Meanwhile, U.S. consumer prices rose at their slowest annual pace since April 2021. MicroStrategy broke out along with the rest of the crypto market.

❌ On Thursday, stocks snapped their 10-day winning streak in a marginally down day. Walmart pushed to new all-time highs after its sales beat expectations. Also, Alibaba jumped on news that David Tepper’s Appaloosa Management has been buying Chinese stocks, and crypto miners capped off an exciting first quarter.

🗓️ On Friday, U.S. stocks closed higher for the fourth straight week. Traders moved on from meme stocks to metals and mining stocks, with the uranium market starting to go nuclear again. And lastly, Dow Theory questioned the legitimacy of the Dow Jones Industrial Average’s 40,000 milestone.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $GME, $AMC, $BB, $FFIE, $BABA, and $RENT.

Here are the closing prices:

S&P 500 | 5,303 | +1.54% |

Nasdaq | 16,686 | +2.11% |

Russell 2000 | 2,096 | +1.74% |

Dow Jones | 40,004 | +1.31% |

Bullets From The Weekend

🧒 The business of eternal youth is booming. Consumers, especially wealthy ones, are spending big on spas, food subscriptions, gym memberships, pills, and more. The wellness industry is worth roughly $500 billion in the U.S. and $2 trillion globally, with per capita spending on wellness in North America topping $5,100 annually compared to $1,600 in Europe. Technology has allowed people to collect tons of data on their health through phones, watches, and rings to create a personalized health approach. Axios has more.

😡 Slack’s sneaky AI training policy has people upset. The Salesforce-owned chat platform is tapping its own user data to train some of its new AI services. While that’s not uncommon in the current environment, users are upset about the company’s opt-out policy. The details were discovered in an out-of-date, confusing privacy policy that virtually nobody visited. It tells users they need to email the company to opt out of Slack using their data for AI training, with the media surfacing these concerns now. More from TechCrunch.

🥪 The lunch rush is dead, with Americans living for the weekend. New transaction data shows office workers are saving their weekday lunch money to splurge on weekend meals and happy hour drinks. Weekday transaction volumes from 11 am to 2 pm were down 3.30% YoY compared to 2019 but up 4.20% on weekends and 0.30% during weekday happy hours (4 pm to 6 pm). That’s a problem for many bars’ and restaurants’ lunchtime business, many of which have not recovered to pre-pandemic levels in the hybrid-work-policy environment. NBC News has more.

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

It's a lighter week of hard economic data, with many Fed members speaking early in the week. In addition to the above, check out this week's complete list of economic releases.

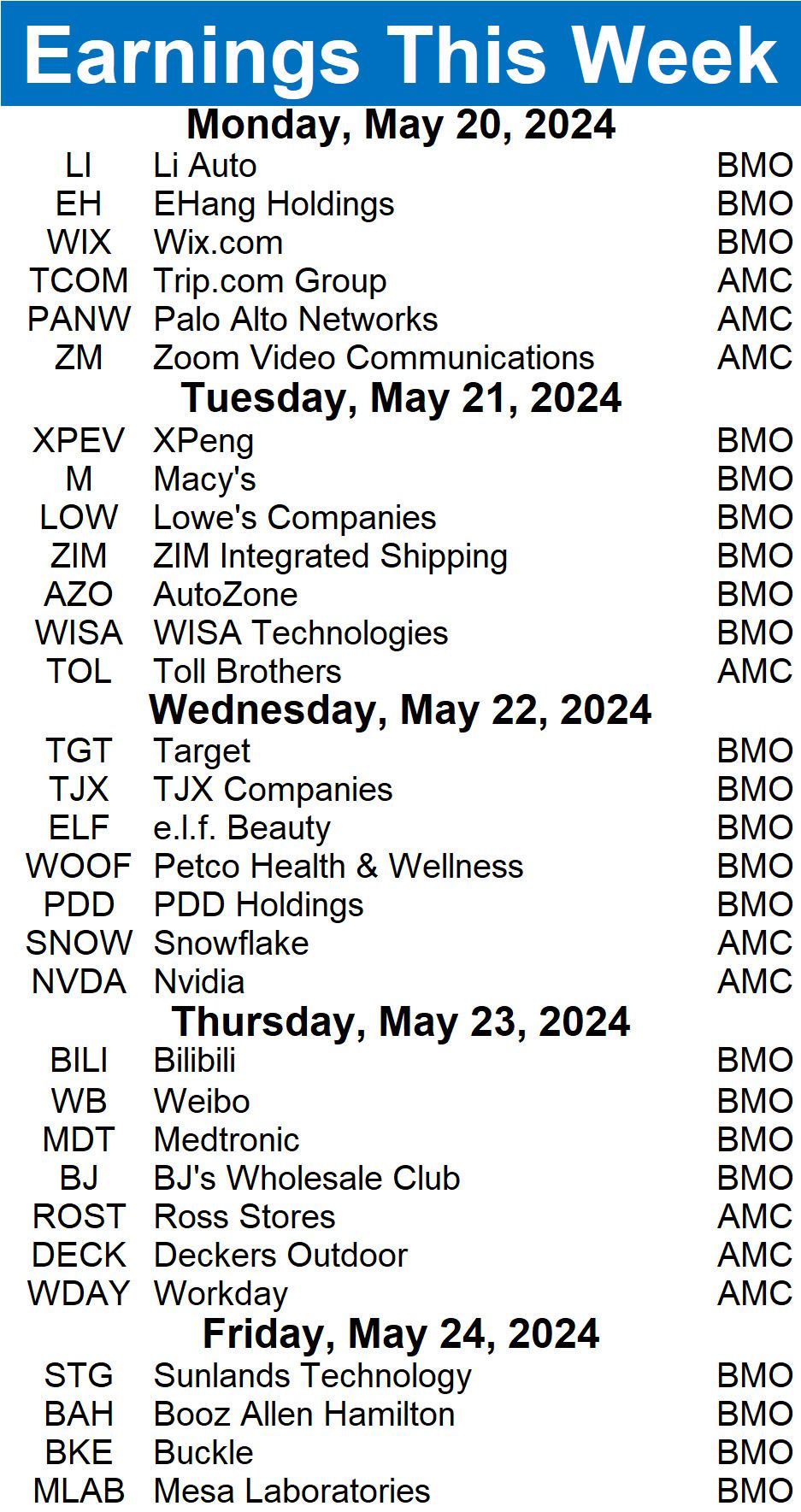

Earnings This Week

Earnings season is slowing down, with 152 stocks reporting this week. Some tickers you may recognize are $NVDA, $PDD, $EH, $TGT, $ELF, $PANW, $ZM, $MDT, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍