OVERVIEW

The Weekend Rip: October 06, 2024

Source: Tenor.com

Global conflict and economic news ruled the week, but renewed hopes for a “soft landing” helped stocks end the week in positive territory. 😥

Let's recap and prep you for the week ahead. 📝

What Happened?

🥳 On Monday, stocks broke their streak of sh*tty Septembers by closing positive on the month. With China roaring back, SoftBank looks ready to make more moonshot bets. Stellantis lacked traction, and investors debated how to position their portfolios through year-end.

😨 On Tuesday, the fourth quarter kicked off with more conflict. Investors analyzed a mix of macro headwinds, Exxon Mobil led energy higher, Nike reported dismal results, and several deals happened under the radar.

🔻 On Wednesday, stocks were mixed amid ‘mid’ fundamentals. Tesla sank after missing delivery estimates, Medicare’s updates hammered Humana, Levi’s considered unloading Docker’s, and a tax compliance software stock soared.

🫨 On Thursday, macro made for another messy trading session. Investors made the case for a bull run in energy, speculative plays trended for another day, and EVGo got a boost from the U.S. Department of Energy (DoE).

👨💼 On Friday, a strong employment report propelled stocks back into positive territory. Investors debated the economy and whether bonds have bottomed for the cycle. It was a rough day for several transportation stocks and an architectural services stock soared to new highs.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,751 | +0.22% |

Nasdaq | 18,138 | +0.10% |

Russell 2000 | 2,213 | -0.54% |

Dow Jones | 42,353 | +0.09% |

Bullets From The Weekend 📰

🤖 Foxconn beats estimates on AI demand. The world’s largest contract electronic maker beat third-quarter expectations and posted its highest-ever revenue for the period, citing strong demand for artificial intelligence (AI) servers. QoQ growth benefited from new product launches for smart consumer electronics (including iPhones), but YoY sales were flat. Despite the momentum, management says fourth-quarter results will likely be “roughly in line” with current market expectations. Reuters has more.

🛒 More retailers are rolling out holiday deals now to spur consumer demand. It's the holiday shopping season once again, and retailers are wasting no time in getting cautious consumers to pull out their wallets. With the presidential election next month and a late Thanksgiving in 2024, Amazon Prime Day, Target Circle Week, and Walmart Holiday Deals sale kick off this week, with other retailers like Best Buy and Kohl’s rolling out their own versions, too. More from Axios.

🔺 Vietnam’s quarterly growth rebounds amid export boost. The APAC country reported its strongest economic growth in two years after strong exports, industrial production, and foreign investment offset weather-related issues hitting the economy last month. GDP rose 7.4% YoY, topping the second-quarter’s revised 7.09% rise, a positive sign for multinational corporations that use Vietnam as a regional manufacturing hub. With geopolitical tensions remaining a risk to external demand, the country expects 6% to 6.5% growth this year, with inflation below 4.5%. Reuters has more.

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

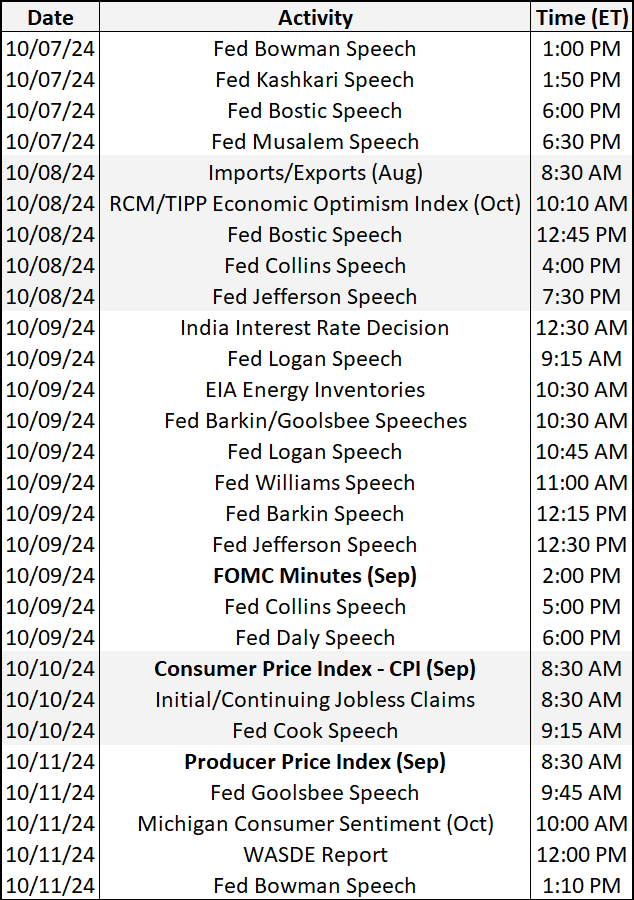

Economic Calendar

Source: TradingEconomics.com

It’s a busy week of economic data, with seemingly every Fed member speaking their mind. However, investors will focus primarily on the FOMC Minutes and inflation data. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

A fresh earnings season kicks off Friday with the big banks. Overall, 27 stocks report this week. Some tickers you may recognize are $TLRY, $DPZ, $PEP, $DAL, $JPM, $BLK, and more.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋