OVERVIEW

The Weekend Rip: September 29, 2024

Source: Tenor.com

U.S. stocks continued their win streak, but global equities were the belle of the ball as China unveiled new monetary stimulus measures. 😋

Let's recap and prep you for the week ahead. 📝

What Happened?

☝️ On Monday, stocks floated to a new record high. Tesla turned on the turbo, Uxin Ltd. shared signs of China’s car market stabilizing, and regulators targeted Exxon Mobil in a first-of-its-kind case.

🌏 On Tuesday, the stock market boom went global. China unveiled a major monetary stimulus package, sending its stock market soaring. Bristol Myers received a boost to its turnaround story, Visa became the DOJ’s latest victim, and StitchFix needed a lot of fixing after earnings.

🏭 On Wednesday, semiconductor stocks bucked the market’s sluggish trend. Micron’s better-than-expected earnings results gave the sector more momentum, Flutter Entertainment and Lowe’s hit new all-time highs, and trouble brewed at OpenAI.

📈 On Thursday, stocks continued their streak into quarter end. Jabil jumped while Super Micro slipped, tech’s rally broadened out to Software, and energy slumped on Saudi Arabia’s production ramp.

🔺 On Friday, stocks closed mixed but secured their third straight week of gains. The Fed’s preferred inflation measure pushed lower, DirecTV and Dish looked to combine, Novo Nordisk neared a major reversal, and investors analyzed how to prepare for a seasonally weak October.

🤩 This week's Stocktwits Top 25 showed underperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,738 | +0.62% |

Nasdaq | 18,120 | +0.95% |

Russell 2000 | 2,225 | -0.14% |

Dow Jones | 42,313 | +0.59% |

Bullets From The Weekend 📰

🏘️ U.S. retailers brace for the impact of potential longshoremen’s strike. A dockworker’s strike is expected to close ports on the East and Gulf coasts beginning on Tuesday at 12:01 ET. National Tree Company CEO Chris Butler is one of many executives concerned about the strike’s impact on business, saying that if ports were to close through November, 150,000 trees might not arrive in time for peak Christmas tree shopping season. With the economy relying heavily on consumer spending to keep growth going, the market does not want to see any disruptions. AP News has more.

⚠️ Apple drops out of talks to join OpenAI investment round. The tech giant has reportedly left negotiations to participate in OpenAI’s latest round, where it’s expected to raise $6.5 billion at a roughly $150 billion valuation. Whether it was the high valuation, the recent exodus of several OpenAI executives, or some other reason remains to be seen. But once again, Apple is showing the discipline that many others aren’t by selectively choosing its strategic investments. More from Reuters.

🧑✈️ The world’s richest inmate was just released after a four-month sentence. Binance founder Changpeng “CZ” Zhao was released from U.S. custody on Friday after serving his sentence for Binance failing to stop widespread criminal activity on its exchange. He pleaded guilty, paid a $50 million fine, and agreed never to take an executive role at Binance again. Still, he’ll retain his 90% stake in Binance, making him the 25th richest person in the world, with a net worth of $61 billion. He’s now expected to work on Giggle Academy, an education platform that he says will bring in no revenue. TechCrunch has more.

STOCKTWITS CONTENT

Celebrating 10k “Chart Art” Subscribers 🥳

We launched “Chart Art” to curate the best analysis and trade ideas from the Stocktwits community. The response so far has been amazing, with the new brand reaching 10,000 subscribers in less than six months.

To celebrate this milestone, we’ve got a special edition of “Chart Art” highlighting the 10 featured trade ideas with the highest returns and rewarding those community members with some new merch!

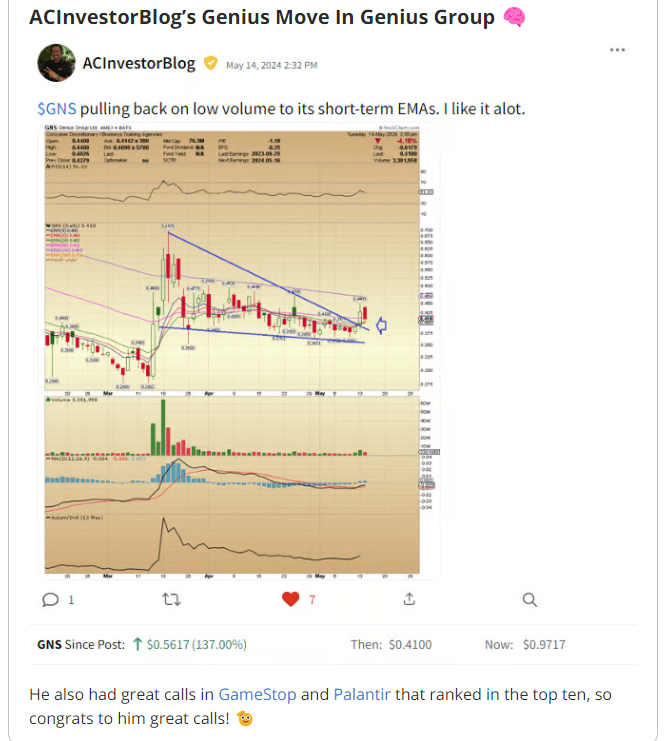

Below is the top idea from @ACInvestorBlog. Genius Group is up 137% since he mentioned it on May 14th with the quote, “I like it a lot.” Nice call!

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

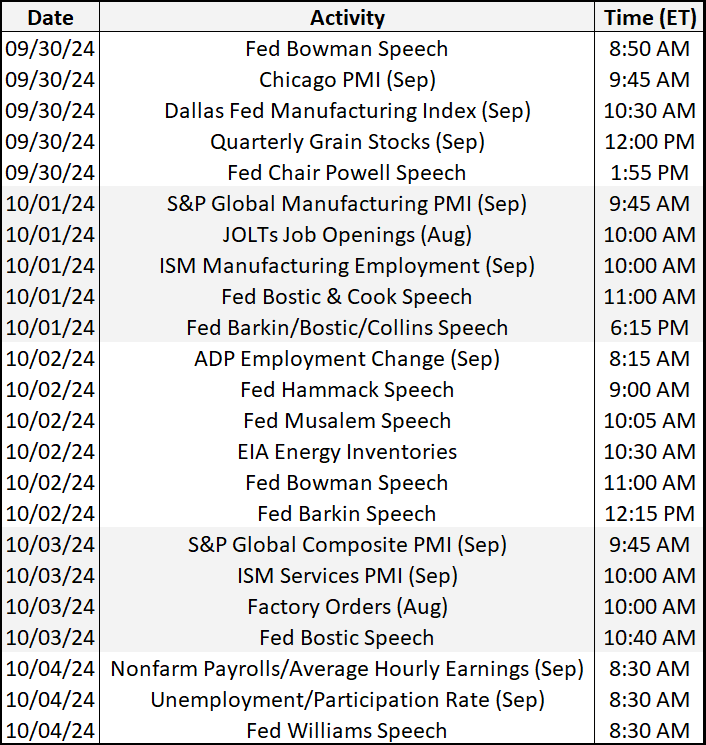

Economic Calendar

Source: TradingEconomics.com

It’s a busy week of economic data, with investors focused on U.S. labor market data and Fed member speeches. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season has slowed to a crawl, with 25 stocks reporting this week. Some tickers you may recognize are $NKE, $STZ, $CAG, $CCL, and more.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

🍨 Breyers ice cream might owe you money after settling a class-action lawsuit. Here’s how to find out

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋