OVERVIEW

The Weekend Rip: September 01, 2024

Source: Tenor.com

It was a sweaty month of August, but bulls managed to close out the month's final week in positive territory…just in time for the three-day weekend. 🏖️

Let's recap and prep you for the week ahead. 📝

What Happened?

🔻 On Monday, big tech pulled back as the market awaited Nvidia’s earnings on Wednesday. Chinese stocks tumbled after PDD Holdings signaled some short-term trouble. Solar stocks showed a mixed outing. And marijuana stocks got smoked again.

😰 On Tuesday, stocks had another mixed showing as everyone prepared for Nvidia’s results. We outlined the social, fundamental, and technical aspects the market was watching ahead of the tech giant’s earnings.

😐 On Wednesday, Nvidia day ended in the red despite the company posting its seventh straight “triple beat,” which means it topped earnings and revenue expectations and raised guidance. Berkshire Hathaway became the first non-tech U.S. company to reach a $1 trillion valuation. Abercrombie & Fitch tumbled after its CEO warned of an “increasingly uncertain environment.”

🙃 On Thursday, the market essentially flipped Wednesday on its head, with Nvidia falling and the rest of the market rising. Dollar General shared some ‘damning’ commentary about the lower-income consumer, OpenAI looked to raise money at more than a $100 billion valuation, and GameStop gained momentum after announcing a retro gaming initiative.

🥲 On Friday, bulls closed out the volatile week (and month) in the green. A Potential Intel breakup caused the stock to rally, Goldman cut 3-4% of its workforce, and downward progress in core PCE continued.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,648 | +0.24% |

Nasdaq | 17,714 | -0.92% |

Russell 2000 | 2,218 | -0.05% |

Dow Jones | 41,563 | +0.94% |

Bullets From The Weekend 📰

🥎 Private equity has a new target…youth sports. With money flowing by the billions into pro and college sports, it’s also coming for kids’ sports. U.S. families spend more than $30 billion annually on youth sports, which operate year-round. Private equity firms are getting into the game, buying exposure into everything from the sports teams to the various businesses supporting the industry, ranging from facilities to coaches to media and merchandise. Axios has more.

🏭 China’s factory data raises pressure for consumer stimulus. The country’s manufacturing activity fell to a six-month low, with prices and new orders tumbling. This is the sixth straight decline and the fourth month below the 50 mark, which separates growth from contraction. Now, policymakers are looking to renew momentum in the world’s second-largest economy by targeting stimulus at households rather than infrastructure projects as it had in the past. The country may bring part of next year’s bond issuance quota into October to try to salvage this year’s growth measures. More from Reuters.

📈 Bluesky gains momentum after Brazil bans X. Brazil’s court decision to ban X is benefitting its rivals big time, especially BlueSky. The microblogging platform said on Friday that it is seeing “all-time highs for activity,” with 500,000 new users joining in the previous two days. The growth is major for the platform, which only fully opened to the public in February. TechCrunch has more.

STOCKTWITS CONTENT

Discover New Trade Ideas With “Chart Art” By Stocktwits

We launched “Chart Art” to curate the best analysis and trade ideas from the Stocktwits community. And so far, thousands of readers have enjoyed discovering new ideas and Stocktwits users to follow each day.

Like this idea shared by Stocktwits user @HostileCharts and featured in Chart Art ahead of the grocer’s nearly 60% rally since late April!

There is so much great content happening on Stocktwits, and it’s our job to help you find it. If you want to join thousands of other traders and investors receiving our “Chart Art” email every evening by 8 pm ET, click here.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

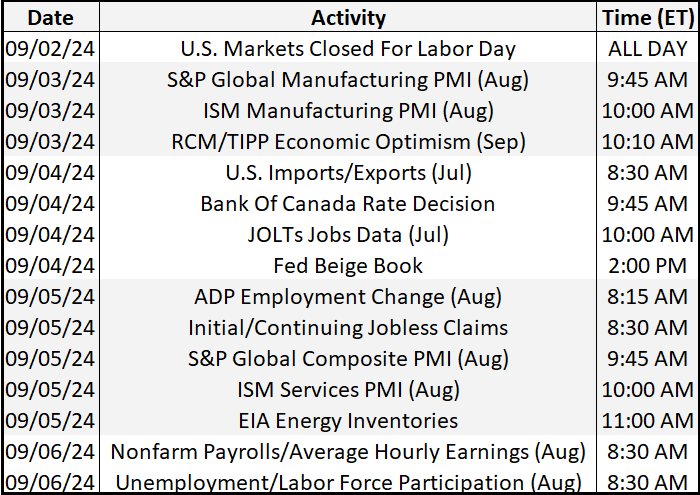

Economic Calendar

Source: Tradingeconomics.com

It’s a busy week of economic data, with investors focused on U.S. employment data coming out Wednesday through Friday. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season is slowing to a crawl, with 84 stocks reporting this week. Some tickers you may recognize are $$AI, $NIO, $CHPT, $HPE, $GTLB, $AVGO, $DOCU, $DKS, $DLTR, and more.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋