OVERVIEW

The Weekend Rip: September 15, 2024

Source: Tenor.com

The broader market’s rebound continued as investors and traders looked ahead with hope to this week’s *likely* Fed rate cut. 📈

Let's recap and prep you for the week ahead. 📝

What Happened?

😌 On Monday, investors experienced their first solace of September as tech stocks jumped. Oracle made new all-time highs on earnings, Google investors faced a bear market conundrum, and Apple’s iPhone event failed to convince bulls.

👀 On Tuesday, the market’s eyes turned to CPI, with the tech-heavy indexes ending the day in the green. Bank stocks gave back some of their gains after offering cautious outlooks, Ryan Cohen keeps playing games with GameStop holders, and consumer discretionary could begin to outperform.

✂️ On Wednesday, stocks flew higher on a tepid CPI reading. Traders took the possibility of a 50 bp rate cut off the table, ‘meme stock’ traders found a better home in Children’s Place, and Palladium confirmed a trend reversal.

😮 On Thursday, stocks continued higher, but Adobe needed Photoshop after its earnings report. Crypto miner Core Scientific perked up, luxury retailer RH surprised investors, and Moderna again missed expectations.

👍 On Friday, stocks closed out a strong week with the Russell 2000 catching up to the larger-cap indexes. Boeing continued to accumulate bruises, SelectQuote was slammed after Q4 earnings, and Medicals Properties Trust soared on settlement news.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,626 | +4.02% |

Nasdaq | 17,683 | +5.95% |

Russell 2000 | 2,178 | +4.35% |

Dow Jones | 41,393 | +2.60% |

Bullets From The Weekend 📰

🏘️ Mortgage rates reach YTD lows ahead of Fed cut. U.S. mortgage rates are at their lowest since early 2023, helping mortgage applications make a 19-month high. However, Realtor.com chief economist Danielle Hale told Axios she doesn’t expect mortgage rates to fall below 6% this year. Record home prices and low inventory remain as existing homeowners, 86% of which have rates under 6%, are reluctant to give up their low rates. Axios has more.

⚠️ China’s new home prices fell at the fastest rate in 9 years. This recent data shows that the country’s supportive measures failed to spur a meaningful recovery in the property sector. New home prices were down 5.30% YoY, its fastest pace since May 2015, after falling 4.90% in July. This is the fourteenth month of MoM price declines, as the property market deals with debt-ridden developers, incomplete constructions, and declining buyer confidence. More from Reuters.

🧑✈️ Air Canada reaches tentative agreement with pilots to avoid strike. The airline and the union representing its pilots have come to terms on a labor agreement that will likely prevent the shutdown threatening to occur at the end of the day on September 17th. The tentative agreement for more than 5,400 Air Canada pilots will generate roughly $1.90 billion in additional compensation for pilots over the four-year term. AP News has more.

STOCKTWITS “TRENDS WITH FRIENDS”

The Stock Market Crash That Wasn’t… 🤔

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

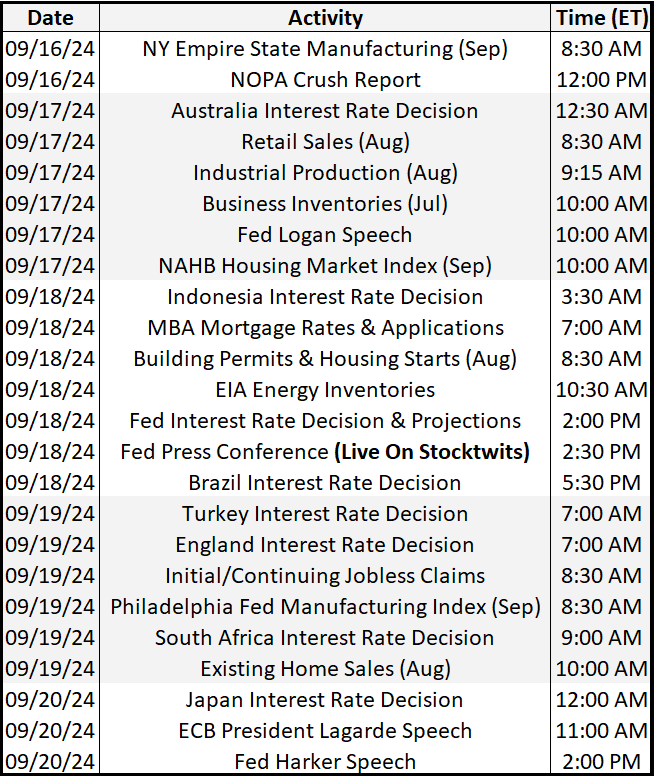

Economic Calendar

Source: TradingEconomics.com

It’s a busy week of economic data, with many central bank decisions around the globe. We’ll be live streaming the Fed’s press conference on Stocktwits this Wednesday, with additional programming before and after the event. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season has slowed to a crawl, with 29 stocks reporting this week. Some tickers you may recognize are $FDX, $LEN, $DRI, $GIS, and more.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋