OVERVIEW

The Weekend Rip: April 28, 2024

Stocks recovered some of their losses this week, with big tech’s earnings helping lead the way through renewed inflation concerns. 😬

Let's recap and prep you for the week ahead. 📝

What Happened?

🧘♂️ On Monday, stocks mellowed out ahead of big tech’s earnings while the New York Stock Exchange (NYSE) toyed with the idea of 24/7 equity trading, and Verizon reported another lackluster quarter.

🪫 On Tuesday, markets remained in the green and extended gains after Tesla reported weak results but suggested its affordable EV model could come as early as the end of 2024. Meanwhile, Spotify shares surged after reporting record profits, and workers scored wins from the Federal Trade Commission (FTC).

😬 On Wednesday, markets were mixed after Meta reported strong results but spooked investors with how much it’ll invest in artificial intelligence (AI) and other long-term bets. A U.S. TikTok ban was pushed through and signed as part of a larger $95 billion foreign aid package. And Tesla remained in a downtrend.

😱 On Thursday, slowing growth and sticky inflation sparked stagflation concerns and dragged the market lower. However, after-hour earnings results from Alphabet, Microsoft, and Snap helped stocks rebound while Bristol-Myers bucked the healthcare boom.

🤑 On Friday, Google joined the $2 trillion club, becoming the fourth U.S. tech stock to top that valuation on a closing basis. Oil and gas giants Exxon Mobil and Chevron confirmed that the industry continues to have a gas problem. And another resources stock broke out to new highs.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $IBRX, $JAGX, $AGBA, $SOFI, $TSLA, and $HOLO.

Here are the closing prices:

S&P 500 | 5,100 | +2.67% |

Nasdaq | 15,928 | +4.23% |

Russell 2000 | 2,002 | +2.79% |

Dow Jones | 38,240 | +0.67% |

Bullets From The Weekend

❌ Daimler Truck narrowly avoids United Auto Workers (UAW) strike. The company, which makes Freightliner and Western Star trucks and Thomas Built buses, was facing a potential strike beginning at midnight ET. However, it agreed on a new labor contract impacting over 7,300 hourly workers in the UAW at six facilities in the U.S. South. It represents another significant win for the union, which has been trying to make inroads into the southern U.S. CNBC has more.

🤔 Grindr’s path could serve as a precedent for TikTok resolution. A group of investors buying LGBTQ+ dating app Grindr from Beijing Kunlun Tech in 2020 offers a prominent example of TikTok’s potential path if ByteDance decides it’s willing to sell the company. The Committee on Foreign Investment in the U.S. .(CFIUS) were primarily concerned with Chinese access to any data, so investors transparently set up whatever structure made the committee comfortable. Clearly, there’s a way to make the divestment work. The question now is whether ByteDance has the will. More from Axios.

🤑 College sophomore’s side hustle reminds us that everything has a price. Brown sophomore Alex Eisler has made $105,000 in reservation sales since November 2022, when he joined an online marketplace that allows users to buy and sell restaurant reservations using an auction model. After completing a few trades manually, the applied math and computer science major built a bot to automate the buying and selling process, netting him $70,000 in profits last year. It goes to show that normal everyday things continue to become gamified to drive demand, especially “exclusive” experiences that higher-income folks are willing to pay up for. Yahoo Finance has more.

SPONSORED

FinChat.io Is The Complete Stock Research Platform For Fundamental Investors

With comprehensive data on more than 100,000 stocks, FinChat has everything you need to track and manage your investments.

From standard financial metrics like revenue and EPS to company-specific measures like AWS Revenue and Tesla Deliveries, FinChat tracks everything so you don't have to.

Best of all, FinChat’s conversational AI assistant can quickly and accurately answer all your investing questions.

“Show me Microsoft’s Cloud Revenue over the last 10 years”

“Summarize Palantir’s latest earnings call”

“How many paying subscribers does Netflix have?”

Get started for free or use code “STOCKTWITS” at checkout for 15% off any paid plans.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

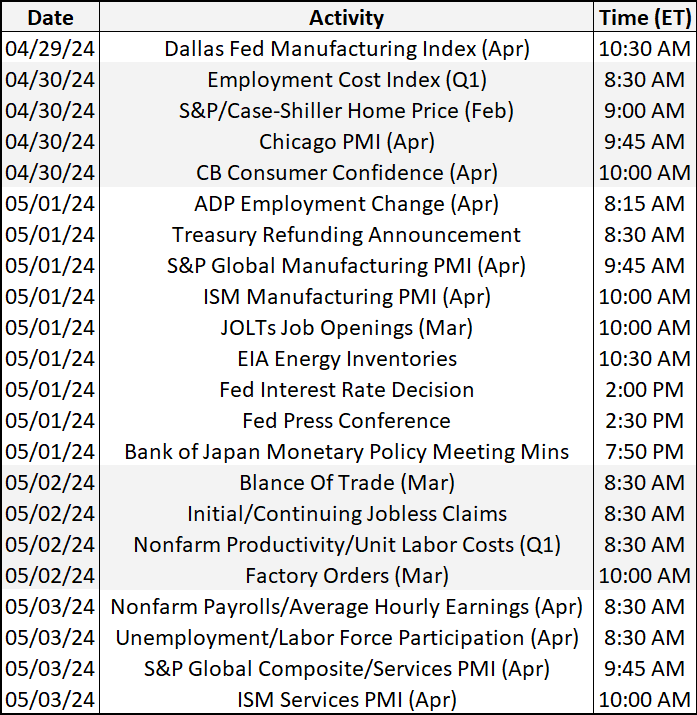

Economic Calendar

It's a major week for economic data, with investors focused on U.S. employment data and the Fed’s interest rate decision. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season is in full swing, with 913 stocks reporting this week. Some tickers you may recognize are $AAPL, $AMZN, $AMD, $COIN, $MSTR, $PTON, $QCOM, $DKNG, $SQ, $PYPL, $SBUX, $MCD, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍