OVERVIEW

The Weekend Rip: July 28, 2024

Tech stocks stumbled after earnings, but better-than-expected economic data renewed hopes for a September rate cut. That caused money to rotate into small-caps and other cyclical sectors. 🔄

Let's recap and prep you for the week ahead. 📝

What Happened?

😬 On Monday, investors cautiously bid up stocks ahead of highly-anticipated earnings. Ryanair lost altitude as airline turbulence continued, AMC refinanced a part of its debt burden, and Berkshire trimmed its Bank of America stake.

⚠️ On Tuesday, mixed earnings performance kept the major indexes under wraps. Tesla tumbled after its automotive revenues failed to impress, Alphabet’s YouTube miss overshadowed otherwise positive results, and UPS failed to deliver while Spotify hit new highs.

❌ On Wednesday, the S&P 500 snapped its 356-day streak without a 2% decline. The “Magnificent Seven” stocks lost more than $700 billion in market cap during the decline, but the Nasdaq 100 maintained its long-term uptrend. Chipotle’s earnings delivered a positive surprise amid strong traffic, while Lamb Weston got mashed due to weak potato demand.

🙁 On Thursday, tech continued to sink as investors rethink their long-term outlook. Southwest Airlines and American Airlines were the latest industry players highlighting significant headwinds. Dexcom was demolished after sales disappointed, and regional bank troubles rumbled under the surface.

🔺 On Friday, stocks rebounded after inflation data came in better than anticipated. The appetite for industrial stocks increased, with 3M, Norfolk Southern, and FTAI Aviation all roaring higher. Booz Allen Hamilton finally experienced the weakness of the rest of the consulting industry’s woes; three beaten-down stocks bounced back, and the SEC sued short seller Andrew Left.

🤩 This week's Stocktwits Top 25 showed underperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,459 | -0.83% |

Nasdaq | 17,358 | -2.08% |

Russell 2000 | 2,260 | +3.47% |

Dow Jones | 40,589 | +0.75% |

Bullets From The Weekend

📝 U.S. union and Apple reach tentative labor deal. The International Association of Machinists and Aerospace Workers (IAM) Coalition of Organized Retail Employees (IAM CORE) reached a tentative deal with the tech giant to improve work-life balance, compensation, and job security. It comes two years after Apple workers at the Towson, Maryland store voted to join the union, becoming the first U.S. retail employees of Apple to unionize. CNBC has more.

😵💫 Crypto firm WazirX decides to ‘socialize’ its $230 million security breach loss among customers. The Mumbai-based firm introduced a controversial plan to deal with a cyber attack that compromised nearly half its reserves. It will “rebalance” customer portfolios so that only 55% of their holdings will be returned and the remaining 45% locked in USDT-equivalent tokens. The plan has sent shockwaves through the crypto community, as WazirX customers ask the firm why it’s not tapping its profit reserves as part of its efforts to make customers whole or reduce the damage. More from TechCrunch.

😧 Senators claim automakers may sell driving data for as little as 26 cents. Consumers have become increasingly concerned about the data their cars generate, how much control they have over their data once it’s generated, and what automakers do with it. Several senators have asked the Federal Trade Commission (FTC) to investigate how automakers collect and disseminate this information after seeing alarming aftermarket data, which suggested Hyundai sold data from 1.70 million cars for about 61 cents per vehicle. PC Mag has more.

STOCKTWITS “TRENDS WITH FRIENDS”

The Bull Market/Degen Economy Rages On 🤑

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

This week, technology expert and investor Michael Parekh is back to discuss Meta’s investment in eyewear giant Luxottica, the all-time highs in several sectors (including financials), Howard’s top picks, and a Swiss technology company the group believes is an undiscovered gem.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

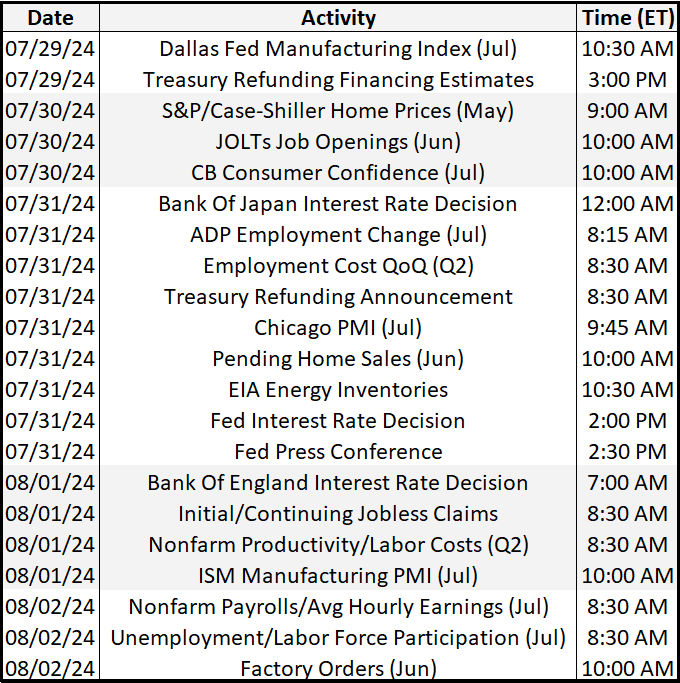

Economic Calendar

It’s a busy week of economic data, with investors focused on the Fed’s rate decision and U.S. labor market data. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

A new earnings season is in full swing, with 914 stocks reporting this week. Some tickers you may recognize are $AAPL, $META, $AMZN, $MSFT, $AMD, $QCOM, $SNAP, $ARM, $SOFI, $SBUX, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍