The Weekend Rip: March 17, 2024

Stocks had their second straight down week, with leading tech stocks facing pressure ahead of this week’s Fed decision and economic projections. 👀

Let's recap and prep you for the week ahead. 📝

What Happened?

🤪 On Monday, meme coins overtook meme stocks on the Stocktwits platform, as Bitcoin jumped above $72,000, Ethereum cracked $4,000, and altcoins soared. Meanwhile, Oracle shares pushed to new all-time highs on the back of AI optimism.

🤩 This week's Stocktwits Top 25 report showed mixed performance relative to the indexes.

🌏 On Tuesday, stock market exuberance went international, with India’s stock market going gangbusters. The Wall Street Journal outlined that nearly 80% of global options activity took place in India during 2023, as the country attracts business and investor attention as the next leading emerging market.

⚒️ On Wednesday, the market was mixed, with Fisker plummeting on a potential bankruptcy filing and Palantir’s CEO taunting short sellers. Meanwhile, Dr. Copper’s breakout renewed focus on commodities as energy also broke out.

⏪ On Thursday, the small-cap Russell 2000’s breakout buyers got hustled as the index pulled back. Unlike Oracle, Adobe did not receive an AI boost and fell sharply after providing a soft sales forecast.

😬 On Friday, traders went cuckoo for commodities, with cocoa soaring to new all-time highs and orange juice popping. Tech stocks hung in the balance, closing right at trendline support ahead of next week’s Bank of Japan and Federal Reserve interest rate decisions.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $MDAI, $PGY, $HOLO, $SOUN, and $BA.

Here are the closing prices:

S&P 500 | 5,117 | -0.13% |

Nasdaq | 15,973 | -0.70% |

Russell 2000 | 2,039 | -2.08% |

Dow Jones | 38,715 | -0.02% |

Bullets From The Weekend

🛜 The FCC finally defines what does not qualify as “broadband” speed. The Federal Communication Commission (FCC) commissioner Jessica Rosenworcel argued nine years ago that 100Mbps should be the new threshold for U.S. broadband performance. After being stuck at 25Mbps/3Mbps since 2015, the FCC just changed its definition of “broadband” to mean download speeds of 100Mbps and upload speeds of 20Mbps, creating a new standard for evaluating the country’s internet deserts. The Verge has more.

🎲 LinkedIn is adding something unexpected to its platform. The Microsoft-owned professional social platform has over 1 billion users and is investing heavily in features like news to help drive user retention and time on the platform. While those efforts have worked, LinkedIn is now introducing gaming in another attempt to keep people online. It’s looking to do so by tapping into the same wave of puzzle mania that has helped simple games like Wordle go viral and develop sustained interest from users. The company confirmed these reports but did not provide a launch date. More from TechCrunch.

📋 Private equity takes majority stake in global accounting giant. Grant Thornton announced a strategic partnership with New Mountain Capital, selling a majority stake to the private equity firm as the accounting and professional services industry continues to attract capital. The cash and debt financing will be used to return capital to current partners, buy out retirement obligations to former partners, and fund the firm’s growth investments. GoingConcern has more.

STOCKTWITS CONTENT

Your Final Chance To Enter 🚨

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

In this week's episode, the friends discuss:

Crypto: Meme coins as an established asset class and crypto ETF action hitting records 🤑

Traditional Markets: Precious metals on the move as money rotates into consumer staples and energy 🛡️

Social: The changing social media landscape, creator economy, and taking control of personal data 🤳

Giveaway: Secure your chance to win a Macbook Pro on March 17 by entering here 🚨

THE BRIEF

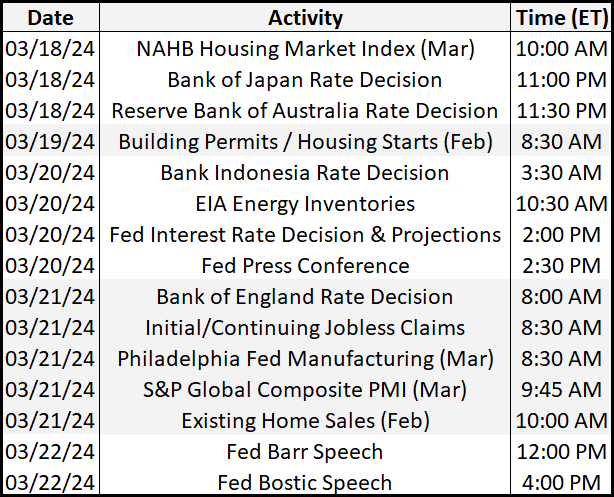

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

It's a big week for central bank decisions, with investors focused on the Federal Reserve and Bank of Japan. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season continues its slowdown, with 256 companies reporting this week. Some tickers you may recognize are $FDX, $NKE, $LULU, $BTBT, $KBH, $MU, $PDD, $LUNR, $TIGR, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

STOCKTWITS CONTENT

A Can’t-Miss Market Event 👀

We will be live with the one and only Tom Lee of Fundstrat & Bitwise CEO Hunter Horsley to discuss all things markets & crypto on Tuesday, March 19th at 3PM EST! 🗓️

Beluga Founder Sonny Singh will be joining as well to moderate this marketing-moving conversation. Save your spot by clicking here.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍