The Weekend Rip: March 24, 2024

Time flies when you’re in a bull market, apparently. The last week of the first quarter is upon us, with stocks having a stellar start to the year so far. 👀

Let's recap and prep you for the shortened week ahead. 📝

What Happened?

🤖 On Monday, mega-caps rebounded after Google and Apple announced an artificial intelligence (AI) partnership. Meanwhile, energy stocks continued to rise as the oil refiners ETF ($CRAK) hit all-time highs. Lastly, the S&P indexes completed their rebalances, with Super Micro Computer and Decker’s Outdoor replacing Whirpool and Zions Bancorp.

🐂 On Tuesday, bulls pressed their bets ahead of the Fed while the Bank of Japan ended its era of negative interest rates. We also hosted a market-moving discussion between Fundstrat’s Tom Lee and Bitwise Asset Management CEO Hunter Horsley.

🔺 On Wednesday, the Fed kept rates unchanged and updated their “dot plot” to show higher growth and inflation expectations. Retail traders readied for the Reddit IPO, while Signet Jewelers warned that a slowdown in engagements was weighing on business.

📈 On Thursday, there was something to celebrate for everyone, with the Dow Jones Industrial Average hitting new all-time highs and Reddit shares popping 47% in their initial public offering (IPO). FedEx also surged since cost-cutting boosted earnings and allowed it to increase its share buyback.

🥦 On Friday, the stock market indexes closed mixed but ended higher on the week. Policy progress helped boost the marijuana sector, while Trump’s Digital World Acquisition Corp. ($DWAC) gave back some gains on fears that Trump could unload some of his shares to settle his legal issues.

🤩 This week's Stocktwits Top 25 report showed mixed performance relative to the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $MU, $SOUN, $PLNT, $ROOT, and $SOL.X.

Here are the closing prices:

S&P 500 | 5,234 | +2.29% |

Nasdaq | 16,429 | +2.85% |

Russell 2000 | 2,072 | +1.60% |

Dow Jones | 39,476 | +1.97% |

Bullets From The Weekend

🔁 Will Trump’s history with public companies repeat itself? With Digital World Acquisition Corp. set to merge with Trump’s “Truth Social,” some are looking back at his past experiences in the public markets. Trump took his casino company public during the 1990s, netting him millions while investors lost a fortune. With that said supporters say these two situations are extremely different and that the only thing in common is the ticker symbol $DJT. NBC News has more.

🏘️ Could the real estate industry go the way of travel? With the National Association of Realtors’ settlement set to shake up the way realtors are paid, some are questioning whether or not real estate agents are needed at all. Some suggest that, like the travel industry, technological advances will simplify the buying/selling process and give consumers all the tools they need to navigate the experience on their own. While that may not mean realtors go away altogether, it likely means their role will shift toward being long-term consultants in the industry, as we’ve seen in the travel and personal finance industries. More from CNN Business.

✈️ FAA weighs limits for United Airlines after several incidents. The U.S. Federal Aviation Administration (FAA) is considering measures to slow down the airline's growth following a series of safety incidents, including preventing it from adding new routes and barring customers from flying on newly delivered aircraft. United’s corporate safety vice president sent a memo to employees warning them that they’d see more regulators around as they review work processes, manuals, and facilities. Yahoo Finance has more.

STOCKTWITS CONTENT

A Brand New Episode 🍿

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart wizard Ivanhoff every week on "Momentum Monday."

Watch it now on YouTube and subscribe to catch each episode when it goes live!

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

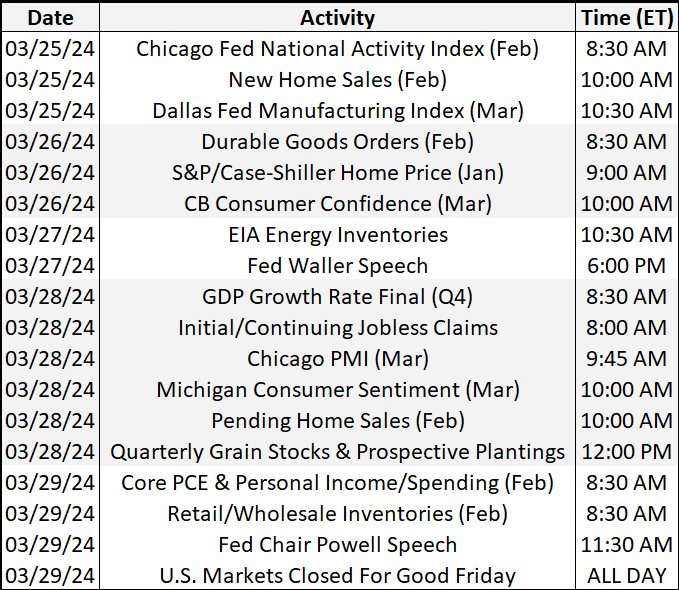

Economic Calendar

It's a busy week for economic data, with investors focused on inflation data and consumer confidence. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season continues its slowdown, with 176 companies reporting this week. Some tickers you may recognize are $GME, $RUM, $BZFD, $WBA, $MKC, $CCL, $ALT, $XXII, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍