OVERVIEW

The Weekend Rip: September 22, 2024

Source: Tenor.com

Stocks closed out a volatile week in the green, with global rate cuts helping buoy the appetite for risk assets. 😋

Let's recap and prep you for the week ahead. 📝

What Happened?

🤷 On Monday, it was a mixed day as Apple and Nvidia dragged down the Nasdaq 100 index. Intel popped as a potential turnaround play, Indian markets topped global stock performance, and projects were announced in the alternative energy space.

⏱️ On Tuesday, stocks were buoyed by rate cut hopes as investors patiently awaited the Fed decision. Canada reached its 2% inflation target ahead of other developed countries, rate cuts $PAVE-d the way for infrastructure stocks, and several partnership announcements were made.

✂️ On Wednesday, the Fed finally delivered, but stocks reversed initial gains to close red. The market read into the Fed’s forecast, Amazon added perks for its workers as the stock attempts to break out, and 23andMe’s independent board all resigned.

📈 On Thursday, investors digested the rate cuts and decided to ramp stocks globally. FedEx’s latest earnings delivery cratered the stock, several more central banks cut rates, and PayPal partnered with Amazon while Darden Restaurants signed a delivery agreement with Uber.

🔻 On Friday, stocks closed down except for the Dow. Beaten-down brands like Nike and Intel caught a bid, Micron showed signs of bottoming before earnings, and the amount of AI investment went nuclear.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,703 | +1.36% |

Nasdaq | 17,948 | +1.49% |

Russell 2000 | 2,228 | +2.08% |

Dow Jones | 42,063 | +1.62% |

Bullets From The Weekend 📰

🏘️ Bonobos founder is betting on friendship. Andy Dunn sold the men’s clothing company to Walmart for more than $300 million, but now, he wants to help adults make friends. The COVID-19 pandemic and widespread use of social media and other technology have helped drive increasing levels of loneliness and mental health struggles. His new app, Pie, is essentially LinkedIn for social life and looks to create a technological solution to help reverse the trend that the sector partially caused. Axios has more.

⚠️ OpenAI closes in on the largest VC round ever. The company is anticipated to raise $6.50 billion at a $150 billion pre-money valuation, with billions in oversubscribed dollars being turned down. To put that in context, $150 billion is what the entire U.S. venture capital market had under management in 1999. It shows just how different a universe that generative AI startups are from the rest of the space, where valuations are still rebounding. More from Axios.

🧑✈️ This Indian firm just acquired Motel 6 for $525 million. One of the country’s largest startups, budget hotel company Oyo, will acquire G6 Hospitality in an all-cash deal. The acquisition includes the Studio 6 extended stay brand, with Oyo dramatically increasing its North American footprint. From its first U.S. location in 2019, it grew to 320 hotels across 35 states, with this deal adding 1,500 locations in the U.S. and Canada. TechCrunch has more.

STOCKTWITS CONTENT

Discover New Trade Ideas With “Chart Art” By Stocktwits

We launched “Chart Art” to curate the best analysis and trade ideas from the Stocktwits community. And so far, thousands of readers have enjoyed discovering new ideas and Stocktwits users to follow each day.

Like this idea shared by Stocktwits user @upsidetrader and featured in Chart Art ahead of the residential real estate stock’s 90% rally!

There is so much great content happening on Stocktwits, and it’s our job to help you find it. If you want to join thousands of other traders and investors receiving our “Chart Art” email every evening by 8 pm ET, click here.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

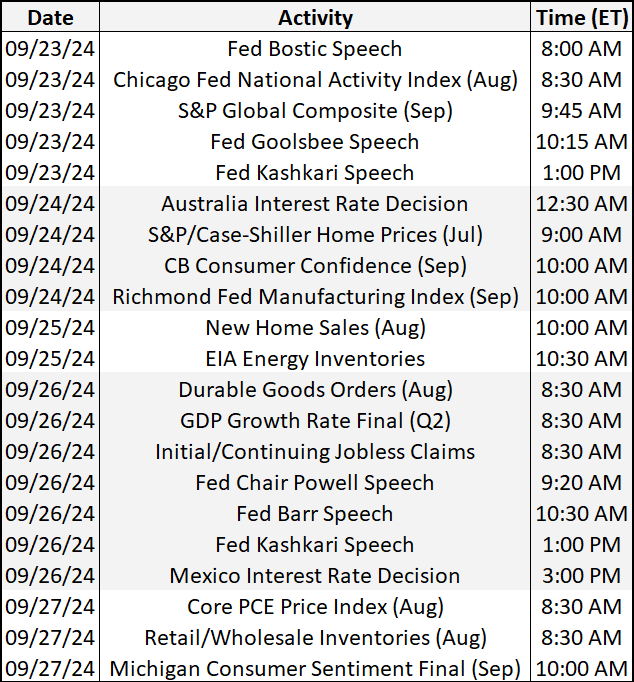

Economic Calendar

Source: TradingEconomics.com

It’s a busy week of economic data, with investors focused on housing updates and Friday’s inflation data. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season has slowed to a crawl, with 31 stocks reporting this week. Some tickers you may recognize are $MU, $COST, $BB, $KMX, and more.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋