OVERVIEW

The Weekend Rip: August 04, 2024

It was another rough week in the markets, with investors racing to protect their portfolios after recession fears kicked into high gear. 😱

Let's recap and prep you for the week ahead. 📝

What Happened?

😳 On Monday, buyers stepped aside ahead of a busy week of earnings and economic events. McDonald’s reported its first comparable sales decline since Q4 2020, causing investors’ sentiment to sour even as prices popped. ON Semiconductor’s sentiment hit one-year highs, and Tilray topped estimates.

😐 On Tuesday, earnings led to a mixed market ahead of the Fed’s decision. Microsoft slipped while AMD ripped, Pinterest shares popped (in a bad way), and Starbucks received treatment similar to McDonald’s after its earnings report.

😮 On Wednesday, Meta’s earnings and Fed commentary added to tech’s upward momentum. Guest author Stock Market Nerd shared his analysis of what he called a “Flawless Quarter” for Meta. The Bank of Japan hiked while the Fed held steady; Nancy Pelosi bought the dip in Nvidia, and Taco Bell parent Yum Brands bet big on AI.

🙃 On Thursday, buyers were battered amid big tech’s results. iPad kids saved Apple’s quarter, but Amazon’s core business slowed again. The Bank of England ended its tightening cycle, and retail bet on a turnaround in Intel, Arm Holdings, and Snap.

😭 On Friday, the unemployment rate ticking up to 4.30% raised recession fears and accelerated the selloff. Markets braced for a “not-so-soft” landing; volatility vaulted the most since the pandemic, and AMC “Apes” were left without answers.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,347 | -2.06% |

Nasdaq | 16,776 | -3.35% |

Russell 2000 | 2,109 | -6.67% |

Dow Jones | 39,737 | -2.10% |

Bullets From The Weekend

💰 Warren Buffett raises cash levels to record $277 billion. Investors raised red flags as they speculated about what Berkshire Hathaway is preparing for. The conglomerate has been a net seller of stocks for seven straight quarters, but that accelerated during the second quarter with it selling more than $75 billion in shares. Additionally, it cut its Apple stake in half, suggesting Buffett and his team aren’t able to find attractive places to put money to work in the current environment. CNBC has more.

🤖 Google takes another AI startup out of the race. Big tech continues to swallow up the artificial intelligence (AI) industry. This time, Google has hired back the AI leadership of Character.AI, which was co-founded by two men who left Google in 2021 due to the company’s bureaucracy. Now, they’re returning to work in Google DeepMind, along with their research team of roughly 30 people. More from The Verge.

🤔 Why some homeowners are giving up their low mortgage rates. An expensive housing market can’t stop young families running out of bedrooms or Baby Boomers who are tired of cleaning an empty house. They plan to refinance if rates drop but aren’t willing to continue waiting to meet their individual needs. First-time homebuyers who can afford it are also jumping on the low inventory of homes for sale as mortgage rates drop below 7%. Axios has more.

SPONSORED

Outperformance occurs when sentiment is misaligned with actual results!

The Earnings Whisper Grade is a tool meticulously designed to harness the consistent, time-tested phenomenon of Post-earnings Announcement Drift (PEAD).

When a stock is highly disliked yet the company's results are strong, it often receives a favorable Earnings Whisper Grade, indicating a likelihood to outperform the overall stock market by holding it over the subsequent quarter. Conversely, stocks that are widely loved but report weak results are more likely to lag behind the market and may even decline during bull markets.

We synthesize this data into a quantifiable grade, offering a strategic asset to enhance your portfolio's performance this earnings season.

As of the middle of 2024, stocks with the highest Earnings Whisper Grades have outperformed the overall stock market by an average of 60.3% per year.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

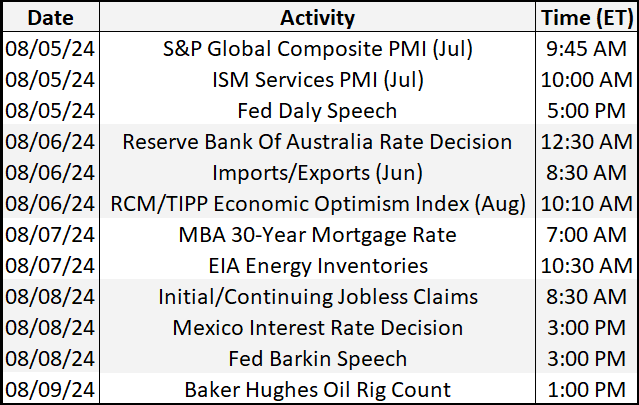

Economic Calendar

It’s a very light week of economic data, with investors focusing on the services industry and foreign central bank interest decisions. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season is in full swing, with 1,144 stocks reporting this week. Some tickers you may recognize are $SMCI, $PLTR, $UBER, $LYFT, $HOOD, $SPCE, $BYND, $JMIA, $CELH, $LCID, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

🧑💻 Register for a free 2-hour trading workshop on 8/10 to learn the fundamentals of sound investing*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍