OVERVIEW

The Weekend Rip: May 12, 2024

Stocks managed to notch their third straight week of gains, with earnings continuing to come in mixed. 👍

Let's recap and prep you for the week ahead. 📝

What Happened?

📊 On Monday, stocks continued to rally as inflation fears dipped. Palantir Technologies tumbled despite noting sector-wide strength, increasing projections, and raising its forecast. Meanwhile, Tyson Foods shares were cooked after the chicken giant delivered a lackluster outlook.

😐 On Tuesday, the market was flat as Disney fell after its total revenue met expectations and earnings beat. Reddit rallied after posting its first quarterly results as a public company, while Rivian failed to impress the market again.

🏹 On Wednesday, it was another mixed day as Reuters reported that authorities are probing Tesla’s Autopilot and Full Self-Driving (FSD) capabilities just days after it received a positive update from Chinese regulators. Meanwhile, Robinhood crushed revenue expectations and set a new quarterly record, as crypto revenue rebounded 232% YoY.

⚒️ On Thursday, the major indexes were green despite earnings being in the red. Commodity excitement continued as copper and silver futures surged, while on the earnings front, Roblox suffered another major “oof” despite trying to diversify its revenue through digital advertising.

💚 On Friday, stocks closed out their green week with another mixed day. Wall Street legend Jim Simons passed away, causing many to recap his illustrious career. Meanwhile, Taiwan Semiconductor saw a 60% jump in YoY revenue, boosting its stock further and renewing growth hopes in the chip space.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $TSLA, $GME, $ROOT, $PYPL, and $CELH.

Here are the closing prices:

S&P 500 | 5,222 | +1.85% |

Nasdaq | 16,340 | +1.14% |

Russell 2000 | 2,058 | +1.18% |

Dow Jones | 39,512 | +2.16% |

Bullets From The Weekend

☢️ Sam Altman’s nuclear energy company plunges on its first day of U.S. trading. The advanced nuclear fission company Oklo went to market by merging with special purpose acquisition company (SPAC) AltC Acquisition Corp., founded and led by Altman. Oklo received roughly $306 million in gross proceeds, while the stock $OKLO fell 54%…valuing it at roughly $364 million. Its business model is based on commercializing nuclear fission through mini nuclear reactors housed in A-frame structures. CNBC has more.

🔋 Chinese EV maker soars in U.S. market debut. Zeekr is the premium brand of Chinese automaker Geely, which also owns Sweden’s Volvo Cars and the U.K.’s Lotus. It was formed in 2021 and has delivered nearly 200,000 cars, mostly in China, though it’s looking to expand to other markets, given the increase in domestic competition. The company was valued at $6.80 billion during its opening trade, rising 35% from there, as U.S. capital market appetite for electric vehicle (EV) firms remains strong despite the recent headwinds. What is noteworthy is that the fully diluted valuation of $6.80 billion is about half the $13 billion valuation from its funding round last year. More from Reuters.

🚫 U.S. CFTC is considering banning bets on certain events. U.S. regulators are reconsidering whether investors and traders should be able to bet on “just about everything.” The U.S. Commodity Futures Trading Commission (CFTC) proposed a formal rejection of event contracts that bet on the outcome of political activity, furthering its efforts to stop U.S. customers from using platforms that allow the trading of predictive contracts. While it has had years-long legal fights with firms like PredictIt, Polymarket, Zeitgeist, and Kalshi, the industry continues to grow alongside other betting markets. CoinDesk has more.

SPONSORED

FinChat.io Is The Complete Stock Research Platform For Fundamental Investors

With comprehensive data on more than 100,000 stocks, FinChat has everything you need to track and manage your investments.

From standard financial metrics like revenue and EPS to company-specific measures like AWS Revenue and Tesla Deliveries, FinChat tracks everything so you don't have to.

Best of all, FinChat’s conversational AI assistant can quickly and accurately answer all your investing questions.

“Show me Microsoft’s Cloud Revenue over the last 10 years”

“Summarize Palantir’s latest earnings call”

“How many paying subscribers does Netflix have?”

Get started for free or use code “STOCKTWITS” at checkout for 15% off any paid plans.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Economic Calendar

It's a lighter week for economic data, with investors focused on the Fed member speeches. In addition to the above, check out this week's complete list of economic releases.

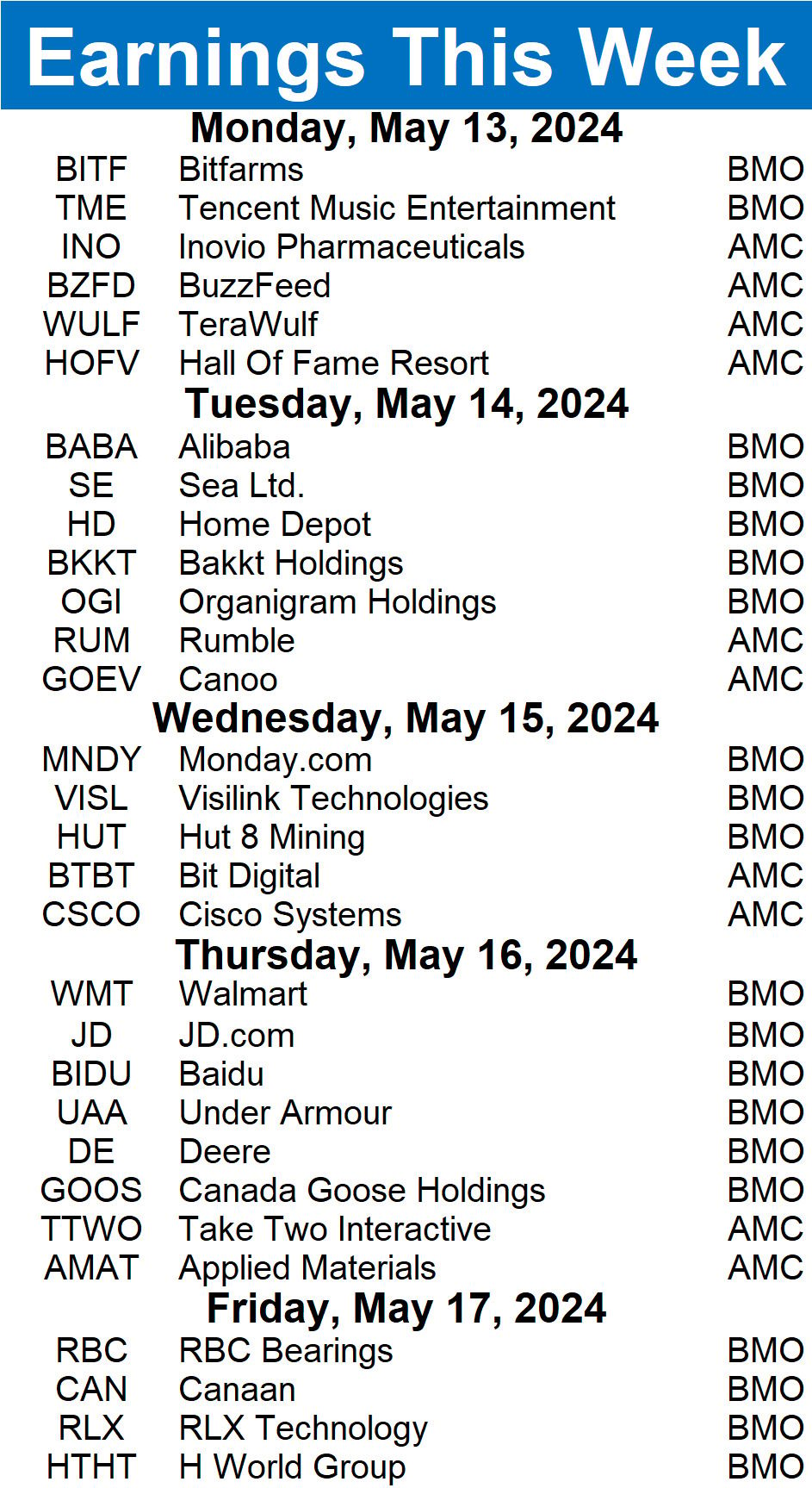

Earnings This Week

Earnings season is slowing down, with 352 stocks reporting this week. Some tickers you may recognize are $BABA, $SE, $BIDU, $HD, $WMT, $AMAT, $RUM, $BZFD, $TME, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍