OVERVIEW

The Weekend Rip: May 26, 2024

The U.S. major indexes closed mixed this week as Nvidia earnings and the spot Ethereum ETF approvals buoyed the tech sector. 👍

Let's recap and prep you for the week ahead. 📝

What Happened?

🏳️ On Monday, one of Wall Street’s biggest bears finally threw in the towel, with Morgan Stanley’s Mike Wilson raising his S&P 500 price target by 20% to 5,400. Meanwhile, crypto prices surged after Bloomberg’s ETF analysts raised their spot Ethereum ETF approval odds to 75%.

😬 On Tuesday, traders and investors stayed on the sidelines as they awaited Nvidia earnings on Wednesday. However, the game did not stop in meme stock land, with presidential candidate Robert F. Kennedy Jr. revealing a position in GameStop…as he looked to tap the meme stock crowd for his campaign.

🤖 On Wednesday, the broader market was down, but Nvidia delivered another earnings beat. Meanwhile, it was a rough day for retailers like Target, Lululemon, and others pummelled by the market. And in the deeply unserious part of the market, former presidential candidate Vivek Ramaswamy took an 8% stake in the beaten-down media brand BuzzFeed.

📉 On Thursday, stocks continued their downside, with Nvidia one of the few stocks in the green. Industrial conglomerate DuPont is the latest to plan a three-way split as it looks to revive a stagnant share price. And after much adieu, the Securities and Exchange Commission (SEC) finally approved spot Ethereum ETFs.

🏖️ On Friday, the market rebounded in the pre-holiday, light-volume trading session. While some retailers are having a rough run, Deckcer’s Outdoor’s and Ross Stores continue their upward trend. Management consulting firm Booz Allen Hamilton also rose to new all-time highs as the current geopolitical turmoil provides a major tailwind to its business.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $SWIN, $GME, $AMC, $FFIE, $GWAV, $BNED, and $NVAX.

Here are the closing prices:

S&P 500 | 5,305 | +0.03% |

Nasdaq | 16,921 | +1.41% |

Russell 2000 | 2,070 | -1.24% |

Dow Jones | 39,070 | -2.33% |

Bullets From The Weekend

💳 Walmart is ending its credit card agreement with Capital One. The nation’s largest retailer has ended its agreement that gave Capital One exclusive rights to issue its consumer credit cards. It previously accused Capital One of being too slow to post transactions to cardholders’ accounts and failing to replace lost cards in a timely manner. This partnership lasted roughly five years after Walmart ended its two-decade-long partnership with Synchrony Financial. CNBC has more.

🛒 Google is joining Walmart by investing in Indian e-commerce giant Flipkart. The company is investing nearly $350 million in Flipkart, becoming the latest high-profile company to back the company. The new investment values the company at $36 billion and will provide $1 billion in fresh capital. According to analysts, Flipkart currently owns roughly 48% of the country’s e-commerce market, which is estimated to be worth $133 billion by next year. More from TechCrunch.

📝 AuditBoard buyout shows boring can be better. The provider of audit and risk management software will be acquired by European private equity firm Hg for $3 billion. The sales price represents more than a 20x multiple on its $40 million Series B round in 2018. While the company had planned to go public in 2025 or 2026, it signed the Hg agreement just four weeks after it was presented despite revenues at a $200 million annual run rate. Axios has more.

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

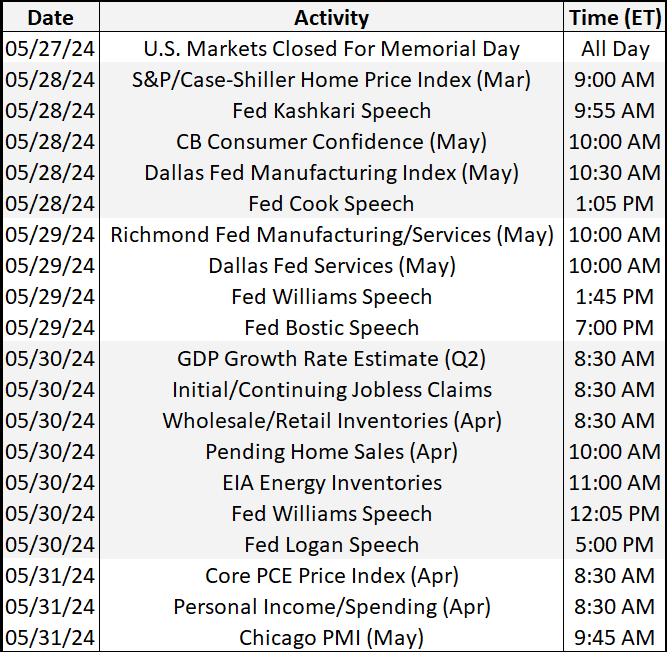

Economic Calendar

It's a full week of hard economic data, with investors focusing on housing data and Friday’s Core PCE and personal income/spending. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season is past its peak, with 106 stocks reporting this week. Some tickers you may recognize are $FFIE, $CHWY, $ANF, $AI, $CRM, $COST, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍