OVERVIEW

The Weekend Rip: October 20, 2024

Source: Tenor.com

Stocks closed out another week in positive territory, as earnings helped propel several market bellwethers to new all-time highs. 🥳

Let's recap and prep you for the week ahead. 📝

What Happened?

📈 On Monday, global stocks rallied after overlooking a ‘lackluster’ China stimulus. Fintech firms and financials felt the love after analyst upgrades, crypto stocks cruised higher after a weekend Bitcoin bump, and it was an M&A-filled day.

⚠️ On Tuesday, ASML’s early earnings release sank the stock market. The semiconductor giant’s cautious outlook hurt stocks, several stocks popped and dropped on key news, and some crazy behavior in nano-cap stocks like $DRUG.

💪 On Wednesday, small-cap stocks finally made their move. Airline stocks soared on the back of United Airlines’ numbers, the beauty industry experienced its latest blemish, and big tech made a big bet on nuclear energy.

🤖 On Thursday, markets were mixed as investors eyed “Mag 7” earnings. Investors gave a thumbs up to Netflix's results, which helped the stock hit all-time highs on Friday. Buyers turned up the heat in Travelers & Taiwan Semiconductor, and “Trends With Friends” talked meme coins and market culture.

👑 On Friday, stocks closed another week in positive territory, but the story of the day was precious metals' pump. Regions and Fifth Third Bancorp reported mixed results, silver broke out to 12-year highs, and Argentina impacted P&G earnings.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,865 | +0.85% |

Nasdaq | 18,490 | +0.80% |

Russell 2000 | 2,276 | +1.87% |

Dow Jones | 43,276 | +0.96% |

Bullets From The Weekend 📰

💰 Spirit Airlines extends debt refinancing deadline with just hours to spare. The struggling budget airline extended a deadline with its credit card processor to renegotiate more than $1 billion in debt. The carrier has furloughed pilots, offered staff buyouts, and deferred aircraft orders to save cash while it tries to stabilize its core business in a post-Jet Blue merger failure world. Shares are at an all-time low. CNBC has more.

🤝 Elliott and Southwest Airlines begin settlement discussions. The activist investor and budget airline have begun discussing a potential settlement to avoid a proxy fight for control of the airline’s board. Elliott has proposed a new framework that would give it representation on Southwest’s board but not control. If a settlement is not met, the 10% owner will force a proxy meeting on December 10th. More from Reuters.

🏦 Bank failure in Lindsay leads to FDIC intervention. Residents of Lindsay, Oklahoma, are facing a rare bank closure after The First National Bank of Lindsay closed on Friday. The Federal Deposit Insurance Corporation (FDIC) will take control to protect depositors, the bank will reopen as The First Bank and Trust Company of Duncan. Still, market bears say this is an early sign of bigger problems ahead for many community and regional banks. Yahoo Finance has more.

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

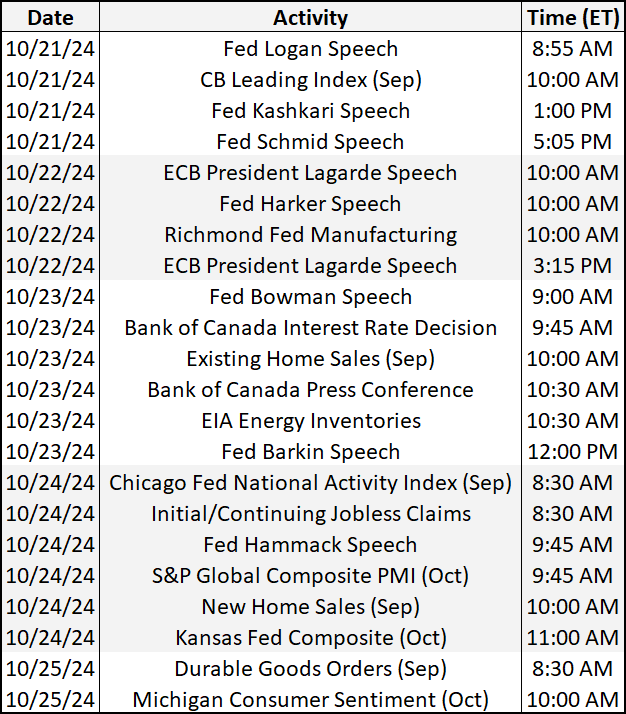

Economic Calendar

Source; TradingEconomics.com

It’s a slower week of economic data, but investors will be focused on the central bank speeches and economic activity barometers like PMI. In addition to the above, check out this week's complete list of economic releases.

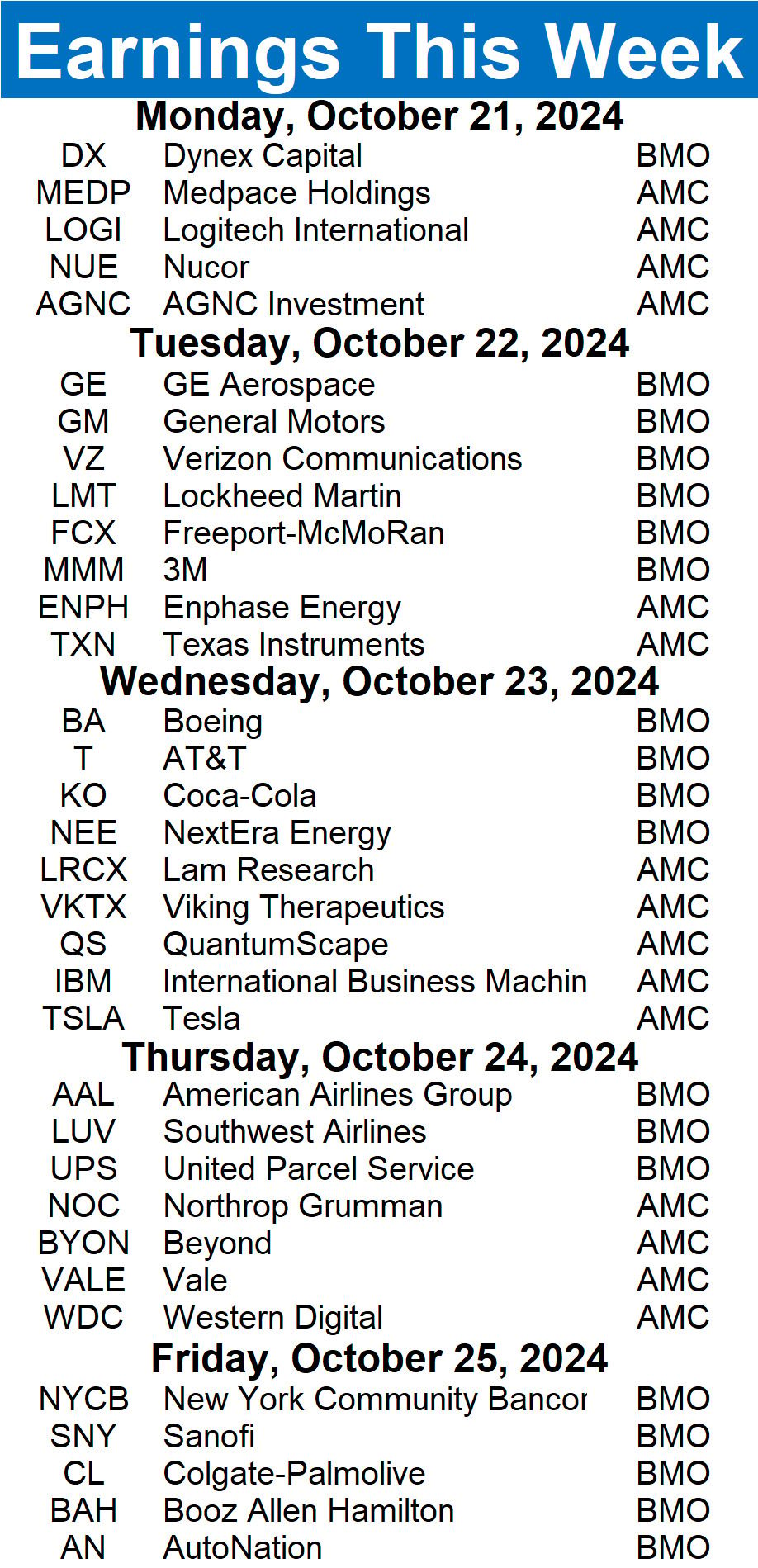

Earnings This Week

Earnings season is officially underway, with 445 stocks reporting this week. Some tickers you may recognize are $TSLA, $ENPH, $VKTX, $LRCX, and $UPS.

Source: Stocktwits.com

Check out the full Stocktwits earnings calendar for the other names reporting this week. P.S. if you add a stock to your watchlist, you’ll get a notification when the earnings call goes live so you can listen directly on Stocktwits. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋